Hammer candlestick pattern structure

Types of Hammer candlestick patterns

Bullish Hammer candlestick pattern

Bearish Hammer candlestick pattern

Advantages and disadvantages of the pattern for technical analysis

How to trade a Hammer candlestick pattern

Is the Hammer candlestick pattern profitable?

Most Forex price action traders rely on candlestick patterns as their main tool for identifying key market reversals. One of the most widely used patterns is the Hammer candlestick. This pattern plays a key role in forming effective trading strategies. In this article, we'll explain how to recognise the Hammer candlestick and how to incorporate it into your trading decisions.

What is a Hammer candlestick?

The Hammer and the Inverted Hammer candlestick patterns are notable for their visual resemblance to a hammer. They both feature a short body on one end and a long wick extending from the other. You can find the Hammer candlestick pattern in all financial markets. Many traders seek out this technical indicator as it is considered a powerful reversal pattern.

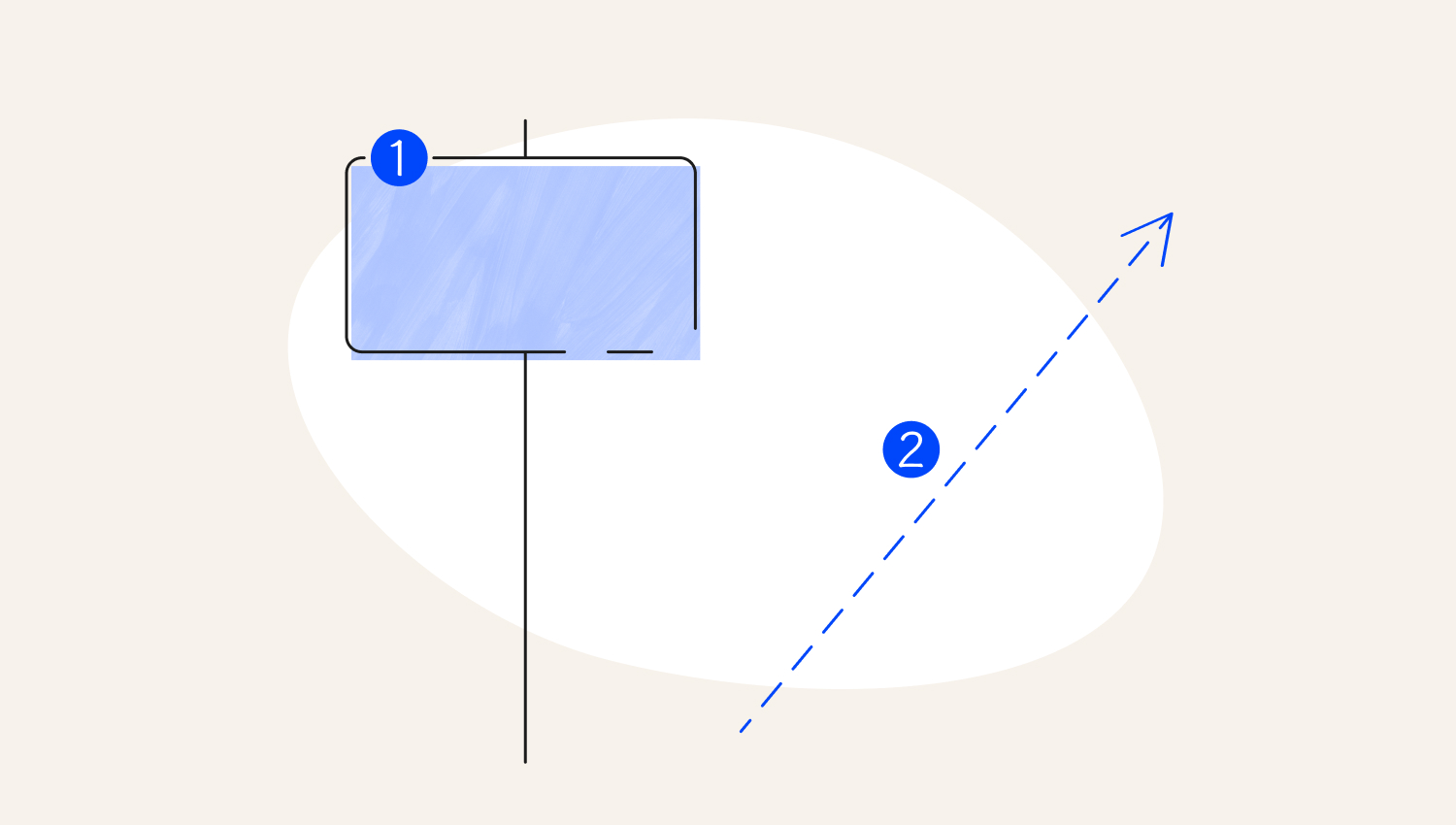

Hammer candlestick pattern structure

In a Hammer candlestick, the opening, closing, and high prices are all situated closely together, indicating potential bullish momentum in the market. This candlestick pattern often signifies a reversal in the prevailing trend, with buyers gaining control after a period of selling pressure. It is characterised by a small body at the top of the candle and a long lower spike, suggesting that bears attempted to push prices lower but were ultimately overpowered by bulls, leading to a potential shift in sentiment. Here are the distinctive features of the Hammer candlestick pattern:

1. Hammer

2. Uptrend (Bullish)

A Hammer can have a bullish or bearish body.

The length of the shadow compared to its body is the main indicator of the Hammer pattern's strength. A strong instrument has a shadow that is more than twice the size of the body. The longer the shadow, the stronger the reversal.

Types of Hammer candlestick patterns

In technical analysis, the Hammer candlestick pattern and its counterpart, the Inverted Hammer, are both significant indicators of potential price reversals in financial markets. Let's consider the difference between them.

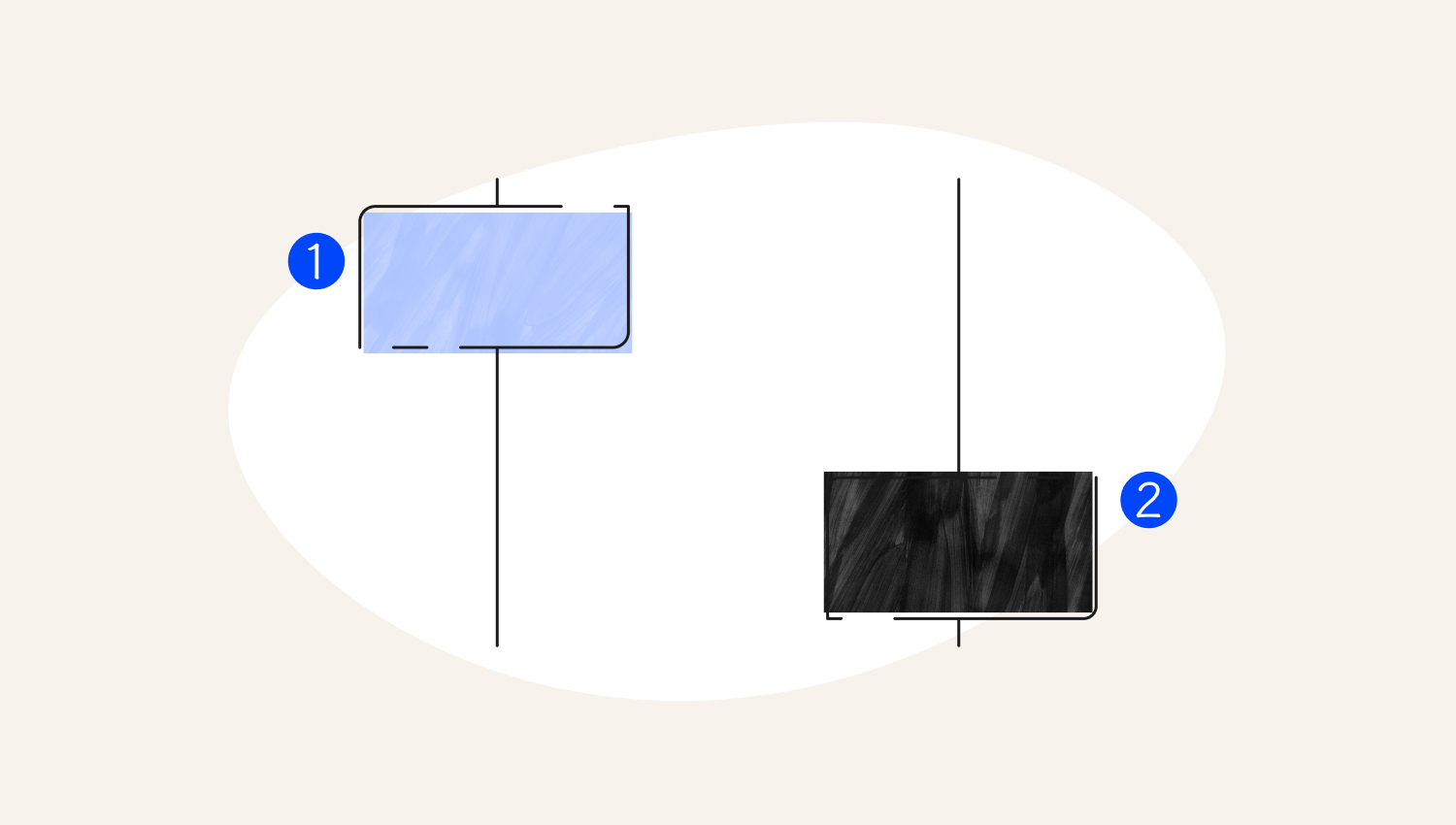

Bullish Hammer candlestick pattern

The Bullish Hammer, as a candlestick pattern, typically emerges when the closing price is above the opening price. It suggests that the market is about to reverse after a downtrend, indicating a potential bullish reversal. To confirm this reversal, traders typically look for an upward closing candle in the subsequent trading period. A distinct variation of the Bullish Hammer is the Inverted Hammer, which appears when the opening price is below the closing price.

1. Hammer

2. Inverted hammer

Bearish Hammer candlestick pattern

The Bearish Hammer, also known as the Hanging Man, indicates potential market reversals. It typically appears after an uptrend and is characterised by a small black body and a long lower shadow, suggesting that selling pressure is beginning to dominate.

The Bearish Hammer forms when the opening price exceeds the closing price, resulting in a black candle. The long lower shadow shows that sellers initially pushed prices down, but then buyers attempted to regain control, ultimately closing near the opening price. This pattern emerges after an uptrend, signalling that buying momentum may be waning and sellers are starting to take over. The presence of the long lower shadow indicates significant selling pressure throughout the trading.

Another Bearish Hammer pattern is a Shooting Star. It occurs when the price attempts to break out upward but ultimately closes below the previous close. It suggests a potential reversal towards a bearish trend.

Advantages and disadvantages of the pattern for technical analysis

Like any other pattern, the Hammer candlestick pattern has advantages and disadvantages when it comes to its usage. To start with, let us delve into the reasons why traders consider Hammer as one of the technical instruments:

- Hammer candlesticks are common and visible on the chart.

- They show a reliable price trend in all financial markets. Traders can use Hammers as reversal or trend continuation patterns.

- These candlesticks are useful when combined with other technical analysis tools.

The most significant drawback of the Hammer pattern is that it may produce erroneous signals. The occurrence of this formation suggests that a trend reversal was anticipated but failed. Thus, traders cannot rely solely on Hammer candlesticks alone for decision-making. Therefore, it is crucial to always corroborate the trend with additional indicators.

How to trade a Hammer candlestick

When traders identify a Hammer candlestick pattern, they can use it to their advantage and make a profit.

To do so, follow the plan below.

- First, the market must be in a trend. Identify the Hammer candle and the bottom of a trending market.

- Wait for confirmation from a candlestick of the previous period. It can be a long bullish pattern or an upward breakout.

- Determine the entry point. It is better to enter the trade immediately after the confirmation candle at the opening of the next period.

- Protect your funds by setting a stop loss lower than the lowest point of the Hammer.

- Select your profit target. It usually depends on your trading strategy. Most often, traders aim for a price that is twice the stop loss.

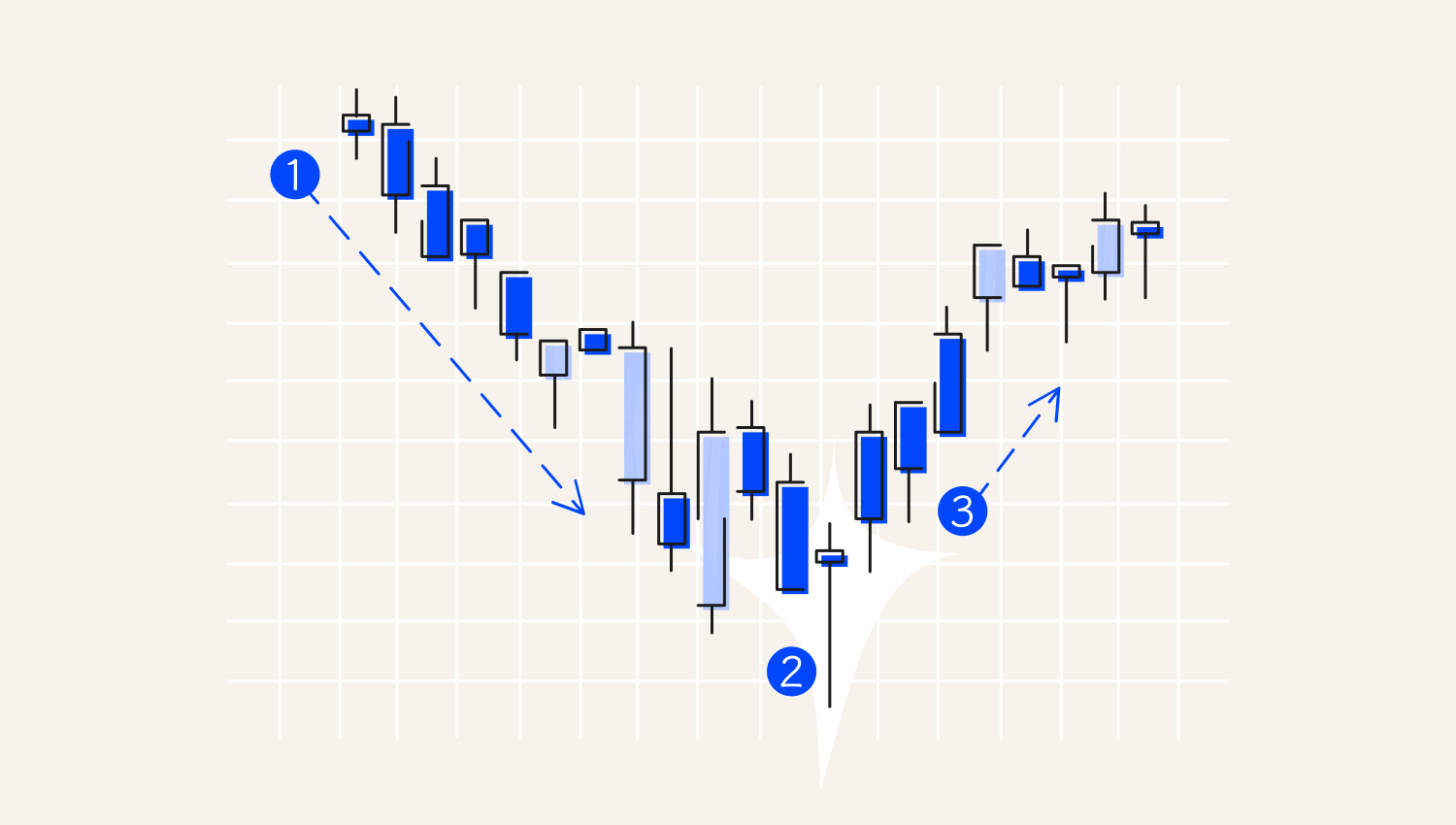

The Hammer pattern should be used in conjunction with other tools, such as Moving Averages, especially for a trend continuation. You can obtain reliable information only through a thorough market examination. The below example illustrates a continuation signal using a 50-moving average. Please note that traders can use the moving average period of their choice.

Example

If we look at the chart presented, we identify the market direction, followed by the formation of the Hammer candlestick. It has a body and a lower shadow that is more than twice as long as the body. Here, the pattern signals a potential trend reversal, meaning that the asset price may go up.

1. Price decline

2. Hammer with long lower shadow

3. Confirmation of price reversal to upside

Then, we see the confirmation. It is on the next candlestick, which shows an upward movement. In this case, the best strategy for traders is to buy during the candle that confirms the reversal trend—the Hammer pattern.

If the asset's value aggressively rises during the confirmation candle, it is important not to forget to set a stop loss below the low of the Hammer or just below the body of the pattern.

Is the Hammer candlestick pattern profitable?

The Hammer pattern is an easily identifiable and reliable indicator of a trend reversal. However, its use alone cannot guarantee profitability, and traders should not rely solely on this pattern. To ensure profitability, the pattern must be confirmed by additional technical or fundamental analysis techniques.

Final thoughts

- The Hammer candlestick is a bullish reversal formation that indicates a possible price trough and an impending upward trend.

- It is characterised by a small real body close to the trading range's upper limit. The body is followed by a long lower wick, which is typically twice or more the body's length. There is no upper wick or it is very short.

- There are two types of this candlestick pattern. The Bullish Hammer candlestick indicates that buyers had the upper hand prior to the end of trading, but there was notable selling pressure. Conversely, the Bearish one suggests that there is strong selling pressure in the market.

- Although the Hammer pattern is a useful tool for helping traders identify possible trend reversal points, it is not necessarily a buy or sell signal on its own.

- It is more effective when combined with other analytical tools and technical indicators.