Our best spreads and conditions

Learn more

Learn more

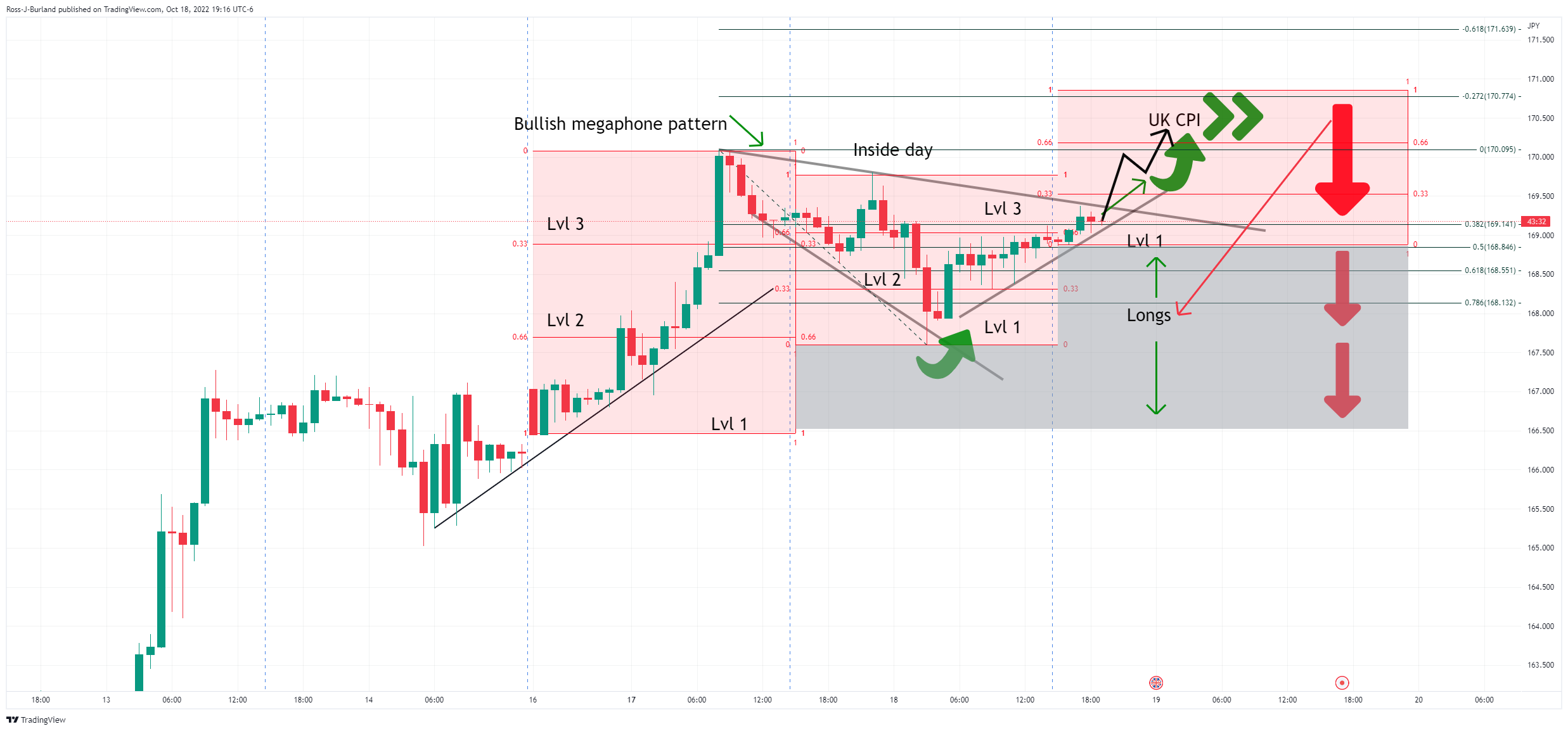

GBP/JPY was another inside day on Wednesday which makes for a coiled market that could be about to spring before the week is out. The following is an illustration of such a scenario that could play out over Thursday:

It was illustrated that the market was an inside day and that there were prospects of a bullish megaphone breakout to the upside if the trendline broke. Instead, the doom and gloom around UK politics and the economy has sunk the pound across the board. There has been a move lower into levels 1 and 2 long positions from the prior day as follows:

While on the backside of the counter trendline, if the 167.50s hold, there could be a move up into the highs for the day to test the commitments of the bears prior to the capitulation of the bulls for a significant sell-off into the rising trend as illustrated in the chart above. 166.43, 165.02 and 162.32 are all key levels on the way down a cascade of market orders.