Back

24 Oct 2022

Gold Futures: Extra rebound appears probable

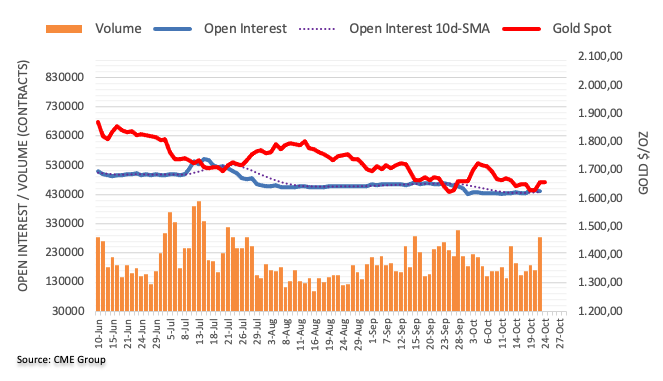

CME Group’s flash data for gold futures markets noted traders trimmed their open interest positions by around 2.7K contracts after three consecutive daily builds on Friday. Volume, instead, resumed the uptrend and rose by around 111.7K contracts.

Gold now looks to $1,700 and beyond

Friday’s strong advance in gold prices was on the back of shrinking open interest, hinting at the likelihood that a sustainable bounce seems out of favour in the very near term. The $1,700 mark per ounce troy, an area coincident with the 55-day SMA, continues to cap the upside for the time being.