Back

24 Oct 2022

Natural Gas Futures: A deeper retracement remains in store

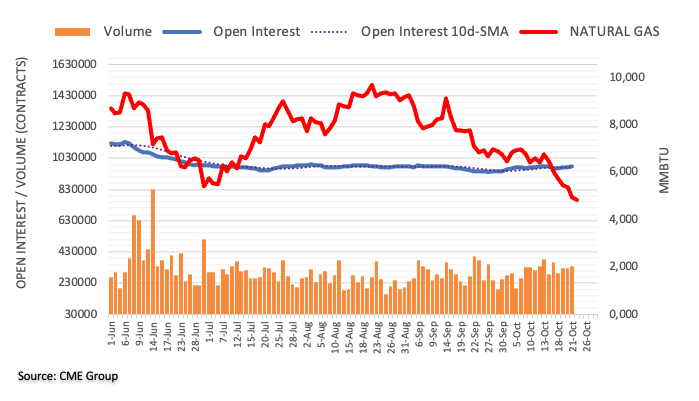

Considering advanced prints from CME Group for natural gas futures markets, open interest went up for the third session in a row on Friday, this time by around 3.5K contracts. In the same line, volume remained choppy and increased by more than 15K contracts.

Natural Gas: A drop below $4.00 seems likely

Prices of natural gas extended the sell-off for yet another session on Friday. The continuation of the downtrend was amidst rising open interest and volume and leaves the door open to extra decline in the short-term horizon. That said, the next contention of note is now seen at the February low around $3.87 mark per MMBtu.