GBP/JPY Price Analysis: Failure to break 170.00 will exacerbate a fall towards 165.00

- GBP/JPY is range-bound, lacking clear direction due to the recent Bank of Japan (BoJ) interventions in the FX markets.

- From a daily chart perspective, the GBP/JPY is neutral-to-upwards biased, though it will face solid resistance around 170.00.

- Short term, the GBP/JPY is neutral biased, though as the RSI shifts bearish, it could exert downward pressure on the GBP.

The GBP/JPY meanders around 168.36 as the Asian session begins, following a huge volatile Monday trading session, with the GBP/JPY registering a daily high and low of 169.78/165.41, respectively, as traders speculate of another BoJ intervention in the FX markets.

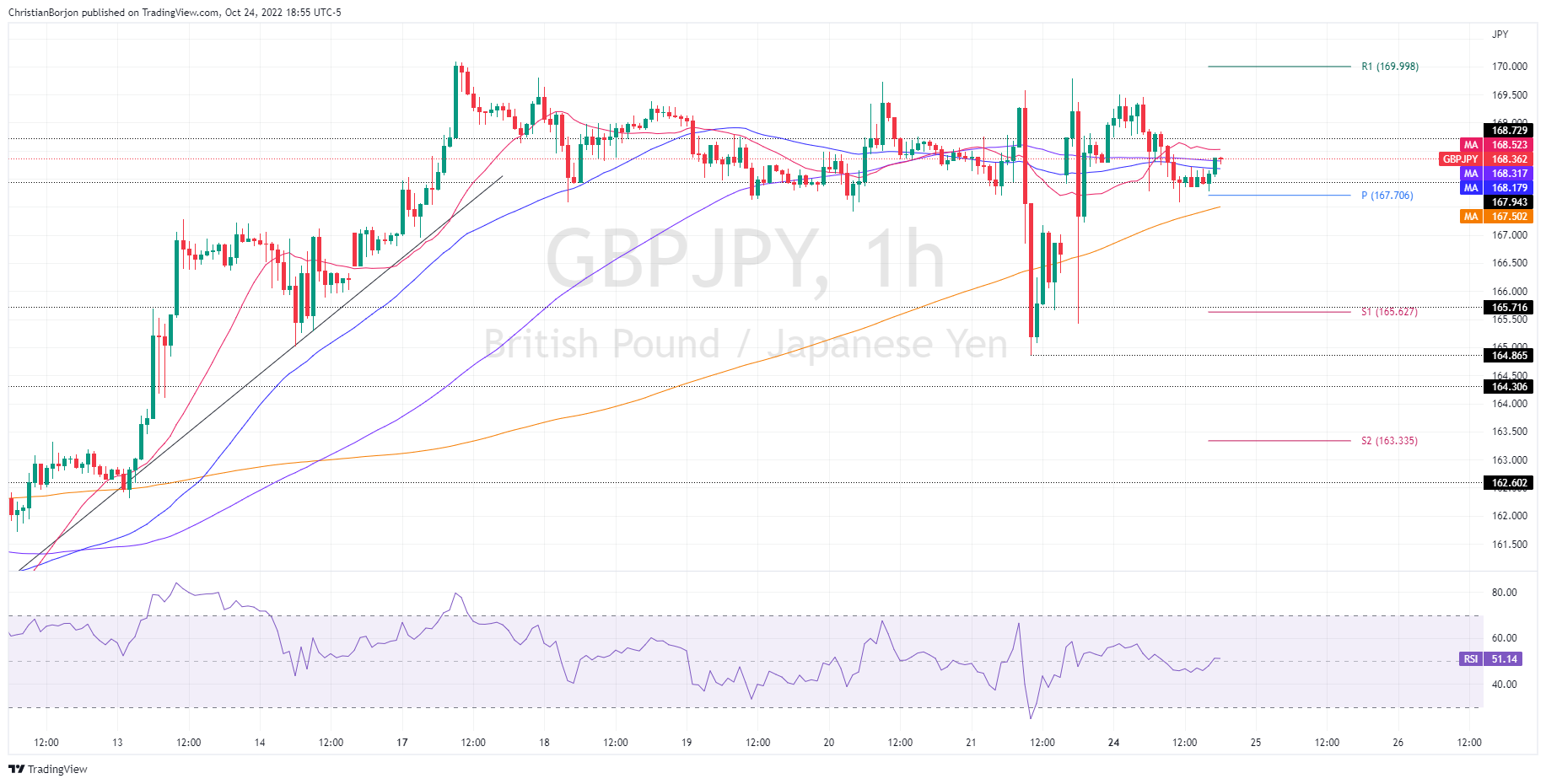

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY daily chart illustrates the pair as neutral to upward biased, consolidated near the year-to-date highs around 165.00-170.00. The price action shows large price swings in the last three days due to the BoJ stepping into the markets, delineating a solid resistance area at around 170.00. Even though the day's lows were capped around 165.00, the GBP/JPY might continue to trade around 168.00-170.00, opening the door for further gains. On the flip side, if the GBP/JPY slides below 168.00, a fall toward 165.00 is on the cards.

The GBP/JPY one-hour time frame depicts the pair as range-bound, forming a top in the 168.00-170.00 area, which GBP buyers had been unable to crack, on its way towards new YTD highs. Worth noting that the Relative Strength Index (RSI) turned bearish, which could exacerbate a move downwards, exposing key support areas.

Hence the GBP/JPY first support would be the 200-Exponential Moving Average (EMA) around 167.50, which, once cleared, would send the GBP/JPY tumbling towards the S1 daily pivot at 165.62, followed by the October 21 daily low at 164.87, ahead of the S2 pivot level at 163.33.

GBP/JPY Key Technical Levels