Back

25 Oct 2022

Natural Gas Futures: Extra weakness appears favoured

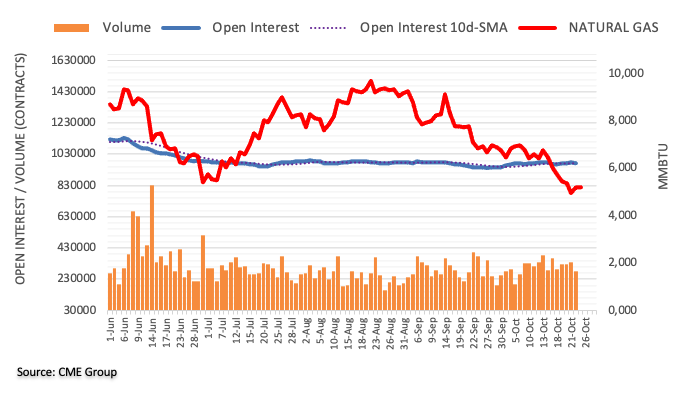

Open interest in natural gas futures markets dropped by around 6.5K contracts on Monday after three consecutive daily builds, according to preliminary readings from CME Group. Volume followed suit and went down by around 60.5K contracts, offsetting the previous daily build.

Natural Gas still targets the $4.30 region

Natural gas prices regained the smile and the area above the $5.00 mark on Monday. The strong advance seen at the beginning of the week, however, was on the back of shrinking open interest and volume, opening the door to the continuation of the downtrend in the very near term. That said, the next support of note now emerges at the March low near the $4.30 mark per MMBtu (March 1).