Back

26 Oct 2022

Natural Gas Futures: Rebound has further legs to go

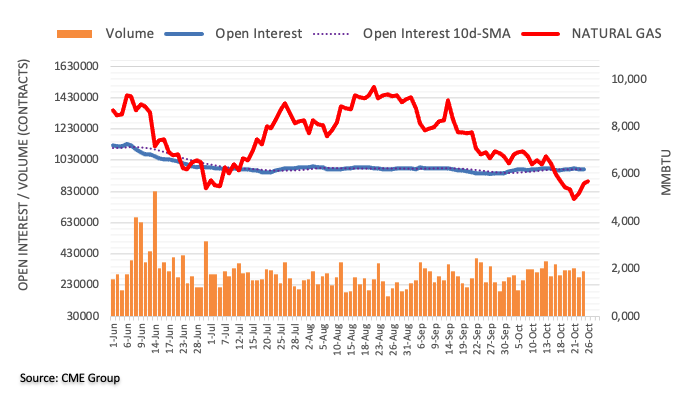

Considering advanced prints from CME Group for natural gas futures markets, open interest resumed the uptrend and rose by around 1.2K contracts on Tuesday. Volume, in the same direction, increased by almost 41K contracts and partially reversed the previous daily drop.

Natural Gas now looks at the 200-day SMA

Prices of the natural gas extended the rebound from multi-month lows (October 24) amidst rising open interest and volume on Tuesday, hinting at the view that further recovery stays on the cards in the very near term. The next up barrier of note, in the meantime, appears at the 200-day SMA, today at $6.718 per MMBtu.