Back

28 Nov 2022

Crude Oil Futures: Scope for further decline

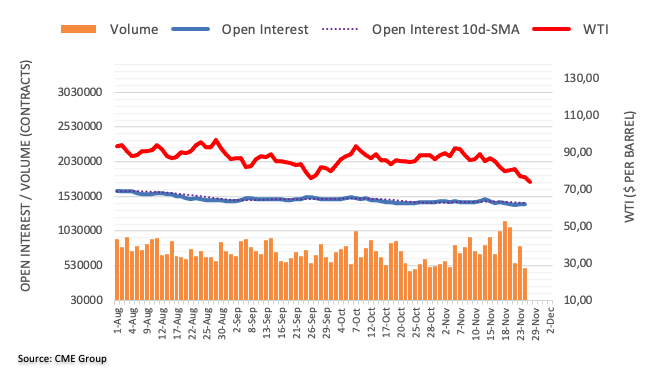

CME Group’s flash data for crude oil futures markets noted traders added just 715 contracts to their open interest positions at the end of last week, reaching the second consecutive build at the same time. Volume left behind the previous daily build and went down by around 312.4K contracts.

WTI: On its way to $70.00?

Prices of the barrel of WTI extended the downtrend on Friday amidst rising open interest, which is supportive of the continuation of the downside in the very near term. Against that crude oil prices could revisit the key $70.00 mark per barrel sooner rather than later.