Back

15 Mar 2023

Natural Gas Futures: Scope for a short-term bounce

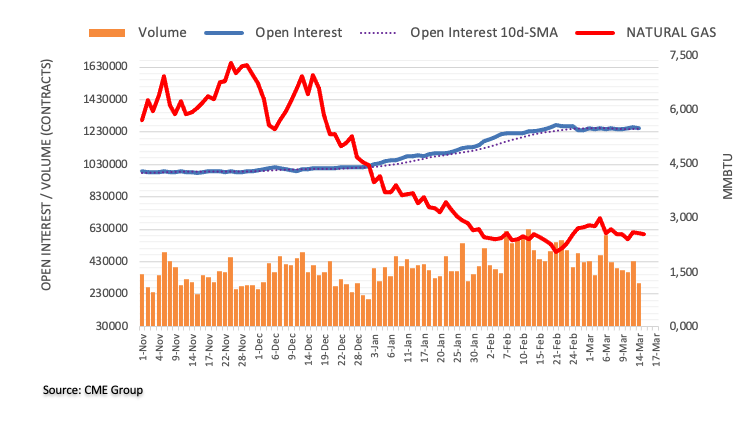

Open interest in natural gas futures markets shrank by nearly 3K contracts on Tuesday after two straight daily builds according to preliminary readings from CME Group. In the same line, volume resumed the downtrend and dropped by around 137.5K contracts.

Natural Gas: Gains remain limited by $3.00 so far

Tuesday’s small retracement in prices of natural gas was came amidst declining open interest and volume and is indicative that a deeper drop still looks not favoured for the time being. Occasional bullish attempts, in the meantime, appears limited by the March peak around the $3.00 mark per MMBtu (March 3).