Back

22 May 2024

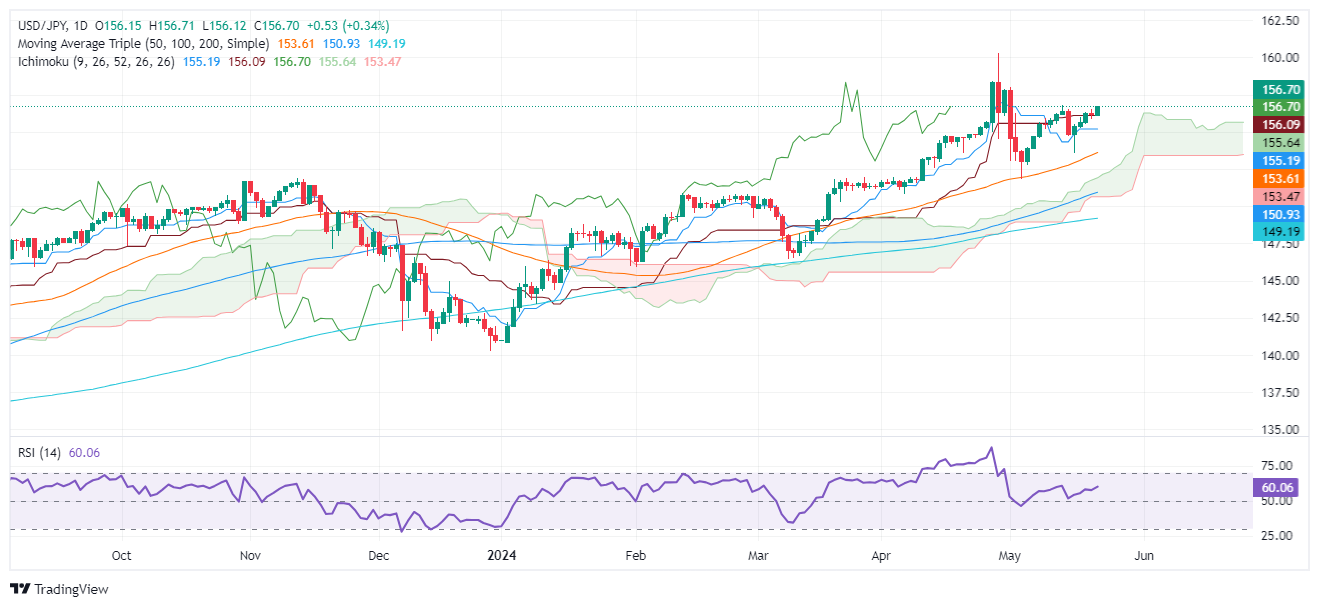

USD/JPY Price Analysis: Faces strong resistance as bulls target 157.00

- USD/JPY erases Tuesday's losses, trading at 156.67, up 0.31% after Fed minutes indicate possible rate hikes.

- Technical outlook shows resistance at May 14 high of 156.76 and next supply area at 157.00.

- Further resistance levels: April 26 high at 158.44 and YTD high at 160.32.

- Key support levels: Tenkan-Sen at 156.05, Senkou Span A at 155.61, and Kijun-Sen at 155.18.

The USD/JPY erased Tuesday’s losses and climbed past the 156.50 area after the announcement of the latest US Federal Reserve meeting minutes. The minutes showed that officials could raise rates if inflation warrants it. The pair trades at 156.67, up 0.31%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY uptrend continues, yet it's facing stir resistance at the May 14 high of 156.76. In the event that buyers reclaim the latter, the 157.00 mark would surface as the next supply area. Further gains lie overhead, with April 26 seen as the next resistance at 158.44, before challenging the year-to-date (YTD) high of 160.32.

Conversely, if the pair drops below the Tenkan-Sen at 156.05, that will expose the Senkou Span A at 155.61, followed by the Kijun-Sen at 155.18.

USD/JPY Price Action – Daily Chart