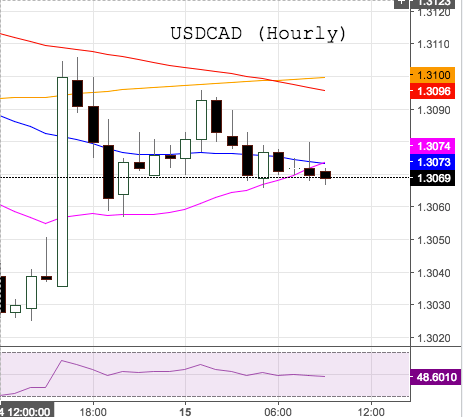

USD/CAD retreats from 1.3100, Yellen, data eyed

The greenback is losing some upside momentum vs. its neighbour on Wednesday, motivating USD/CAD to return to sub-1.3100 levels ahead of key data in the US docket.

USD/CAD gains capped above 1.3100

Spot is trading with marginal losses today despite the persistent bid tone around the greenback following yesterday’s testimony by Chair Yellen and supportive Fedspeak.

Market bets for a rate hike in March has gathered renewed traction after Chief Yellen added to the view of gradual and further rate hikes this year. In the same direction, Yellen noted it would be ‘unwise’ to wait too long to tighten further the monetary policy.

Furthermore, Richmond Fed J.Lacker suggested the Fed may need to hike more than three times this year, advocating for a rate hike at the March meeting.

Data wise today, the second testimony by Yellen before the House Financial Services Committee will be in centre stage, seconded by US inflation figures gauged by the CPI, Industrial Production, TIC Flows, the Empire State index, January’s Retail Sales, the NAHB index and the weekly report on crude oil inventories by the EIA.

In Canada, Manufacturing Shipments are only due.

USD/CAD significant levels

As of writing the pair is losing 0.05% at 1.3068 facing the next support at 1.3046 (low Feb.13) seconded by 1.3016 (low Jan.17) and then 1.2967 (low Jan.31). On the other hand, a surpass of 1.3109 (high Feb.14) would aim for 1.3122 (20-day sma) and finally 1.3215 (high Feb.7).