US Dollar testing tops near 101.40, Yellen on focus

The greenback – tracked by the US Dollar Index (DXY) – is advancing further north of the 101.00 handle on Wednesday, trading in daily highs in the 101.40/45 band.

US Dollar attention to data, Yellen

The index clinched fresh 4-week tops in response to the hawkish message by Chief Janet Yellen at her semi annual testimony on Tuesday.

Yellen reinforced the case for gradual hikes during this year, while subsequent comments by Richmond Fed J.Lacker advocated for a rate hike in March and hinted at the likeliness of more than the initially projected three rate hikes in 2017.

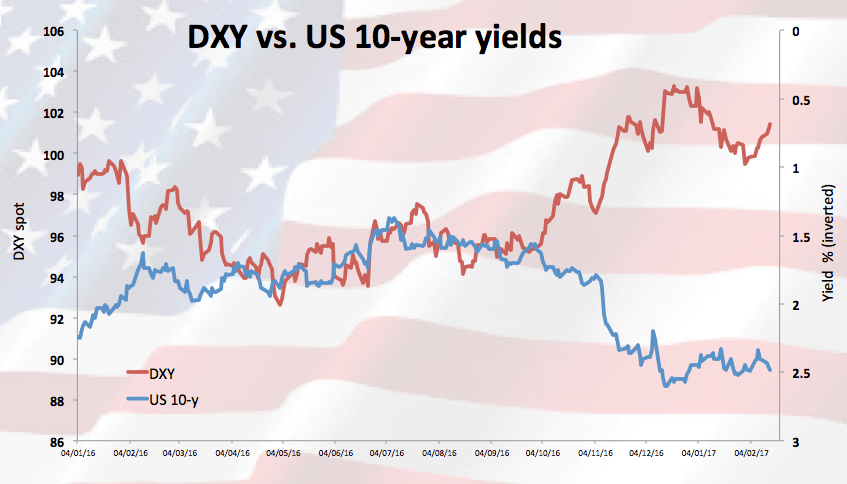

Yellen’s hawkish tone boosted US yields, which in turn gave extra legs to the Dollar’s up move.

On the data front, Yellen’s testimony before the House Financial Services Committee will take centre stage once again, followed by US inflation figures gauged by the CPI, Industrial Production, TIC Flows, the Empire State index, January’s Retail Sales, the NAHB index and the weekly report on crude oil inventories by the EIA.

In addition, Boston Fed E.Rosengren (2019 voter, dovish) and Philly Fed P.Harker (voter, hawkish) are also due to speak.

US Dollar relevant levels

The index is gaining 0.19% at 101.39 and a breakout of 101.71 (high Jan.19) would target 101.95 (23.6% Fibo of the November-January up move) en route to 102.96 (high Jan.11). On the flip side, the next support lines up at 100.56 (low Feb.10) followed by 100.39 (20-day sma) and then 100.03 (low Feb.8).