Back

25 Jun 2018

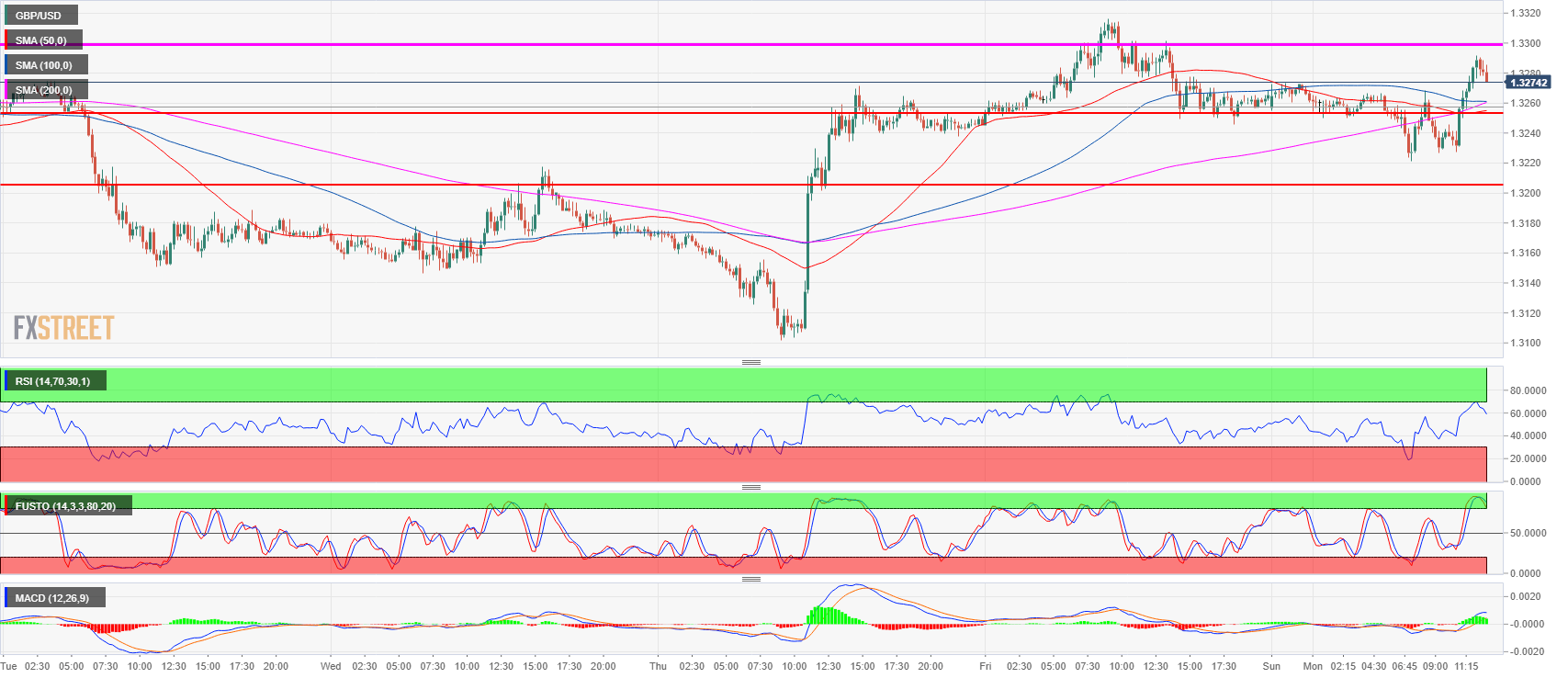

GBP/USD Technical Analysis: Sterling bulls challenging the 1.3300 level

- GBP/USD has found intraday support above the 1.3221 level and the bulls are now currently capped by the 1.3300 figure resistance.

- GBP/USD made a false bear breakout as it almost reached the 1.3200 level in early Europe by reaching the 1.3221 level.

- A breakout above 1.3300 might lead to a move towards the 1.3350 previous supply/demand level while a failure at 1.3300 can lead to a retest of the 1.3260 level, the 200-period simple moving average on the 15-minute chart.

GBP/USD 15-minute chart

Spot rate: 1.3278

Relative change: 0.10%

High: 1.3291

Low: 1.3221

Trend: Bullish

Resistance 1: 1.3300 key support

Resistance 2: 1.3350 supply/demand level

Resistance 3: 1.3400 figure

Support 1: 1.3260, 200-period SMA (15m)

Support 2: 1.3200-1.3221 area, figure and current Monday’s low

Support 3: 1.3146, current 2018 low