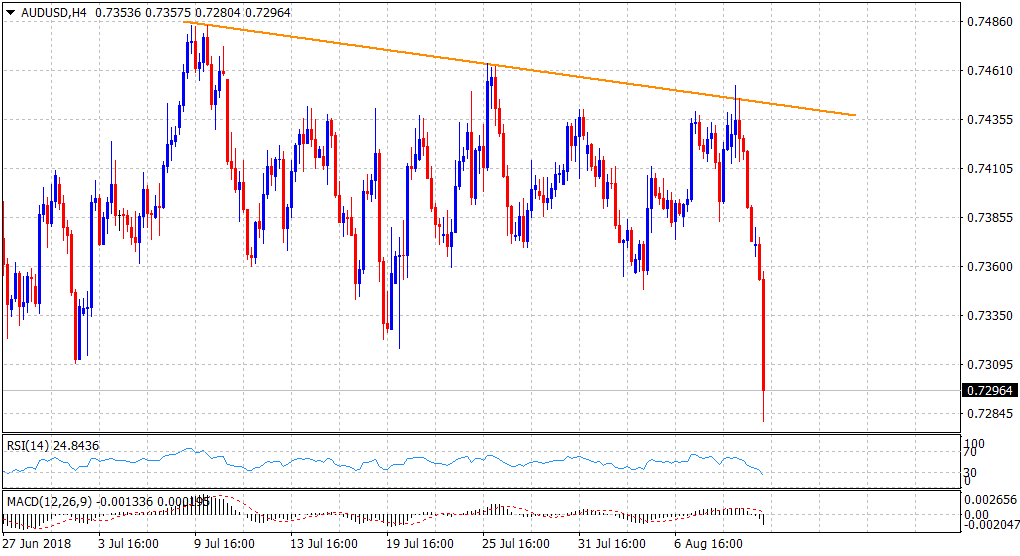

AUD/USD Technical Analysis: Tumbles to 20-month lows, below 0.7300 mark

• The pair extended overnight rejection slide from a one-month-old descending trend-line hurdle, also coinciding with 55-day SMA and tumbled to 20-month lows.

• Weakness below the 0.7300 handle now seems to have confirmed a bearish breakdown below an eight-week-old broader trading range.

• Technical indicators on daily charts are still far from near-term oversold conditions and thus, increase the pair's vulnerability to continue with its downward trajectory.

AUD/USD 4-hourly chart

Spot Rate:

Daily High: 0.7380

Trend: Bearish

Resistance

R1: 0.7310 (previous YTD low set on July 2)

R2: 0.7355 (horizontal zone)

R3: 0.7380 (daily swing high)

Support

S1: 0.7280 (horizontal zone)

S2: 0.7259 (S3 daily pivot-point)

S3: 0.7200 (round figure mark)