Back

9 Jan 2020

JPY Futures: bearish note persists

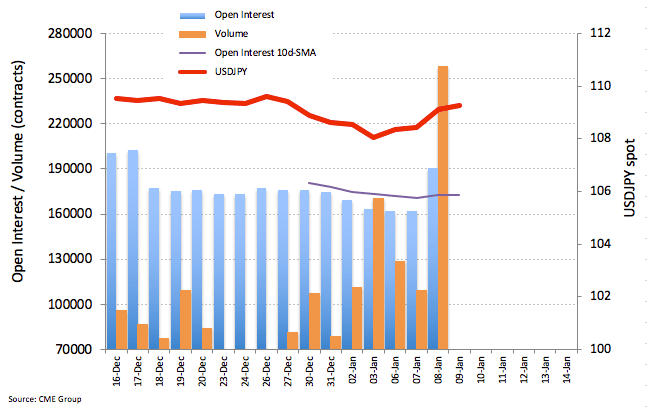

Open interest in JPY futures markets reversed five consecutive drops on Wednesday and rose by almost 28.5K contracts, the largest single-day build so far this year. In the same line, volume rose markedly by nearly 148.8K contracts, also recording the largest build so far in 2020.

USD/JPY now looks to 110.00

Easing geopolitical concerns boosted the outflows from the Japanese safe haven on the back of increasing open interest and volume, allowing for further upside in USD/JPY and opening the door for a potential move to the psychological 110.00 handle.