Back

9 Jan 2020

Crude Oil Futures: extra pullbacks not ruled out

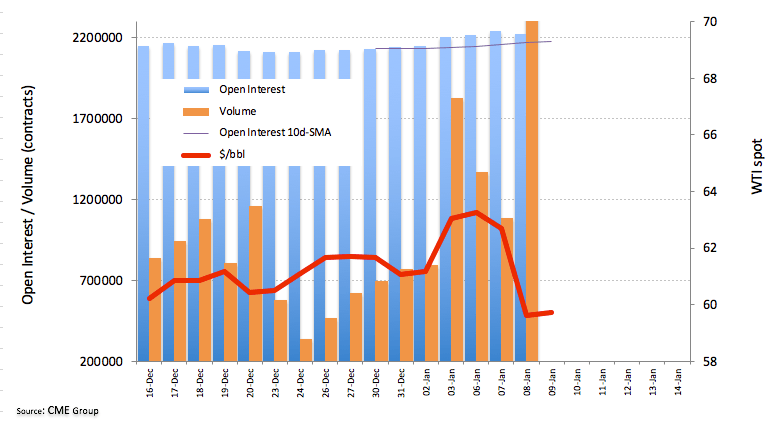

Traders scaled back their open interest positions by nearly 20.3K contracts in Crude Oil futures markets on Wednesday, recording the first drop since December 24th. Volume, instead, reversed to drops in a row and rose significantly by around 1.35M contracts.

WTI breaks below $60.00

Prices of the WTI dropped sharply on Wednesday and breached the critical $60.00 mark in response to alleviating concerns in the Middle East. The important build in volume coupled with the first drop in open interest in several weeks leave the door open for some consolidation, although another move to lower levels should not be discarded.