Back

9 Jan 2020

AUD/USD Price Analysis: Aussie bears eyeing the 0.6800 handle

- AUD/USD is starting 2020 by pulling back down sharply below the December 2019 tops.

- The level to beat for sellers is the 0.6840 support.

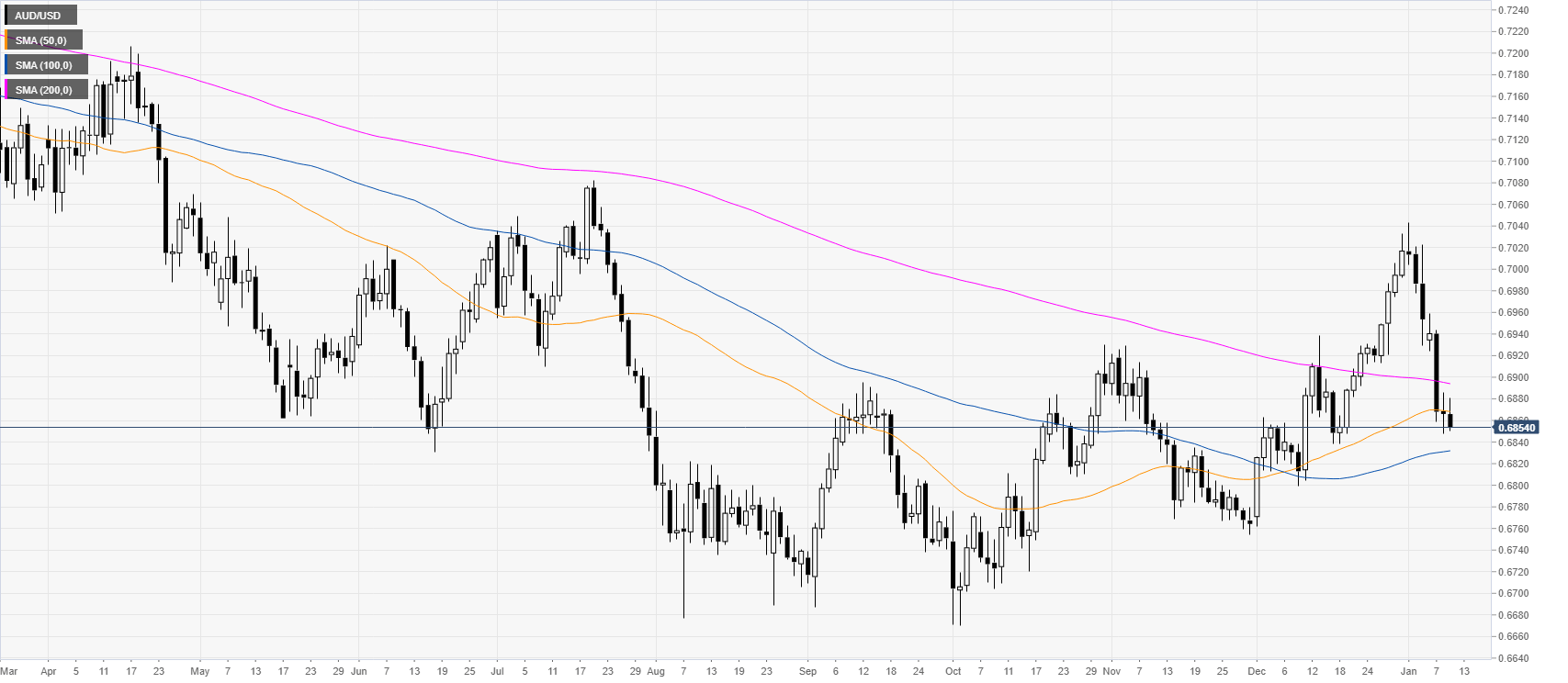

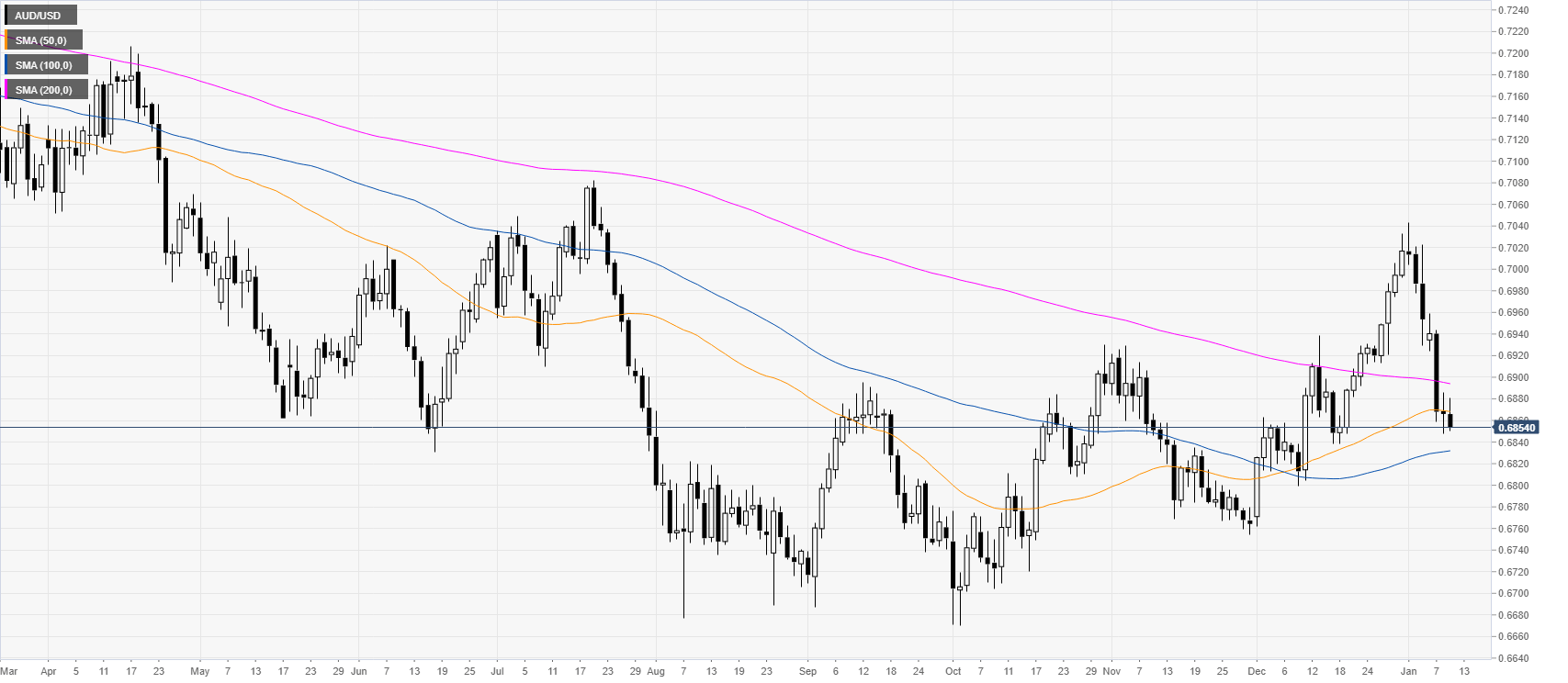

AUD/USD daily chart

AUD/USD is pulling back down sharply from the January highs trading now below the 0.6900 handle and the 50/200-day simple moving averages (SMAs).

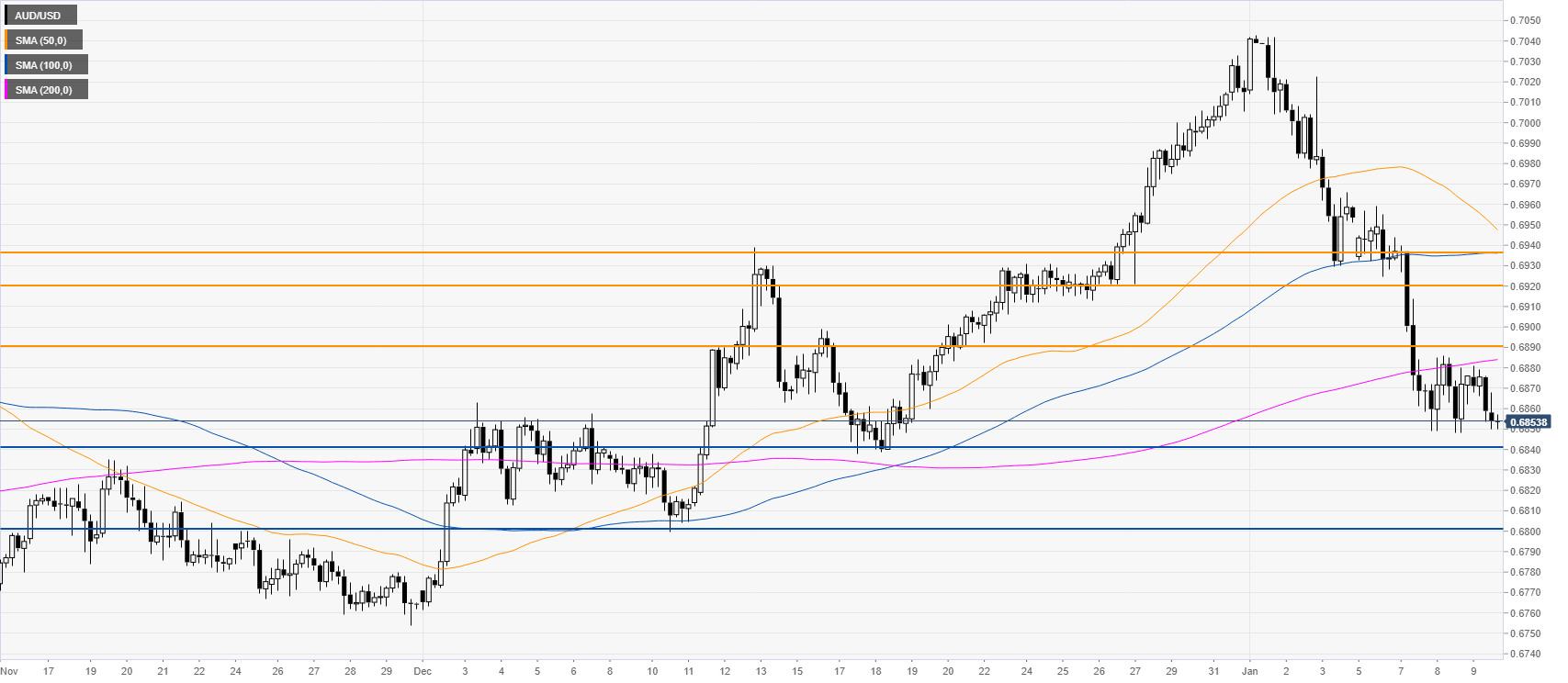

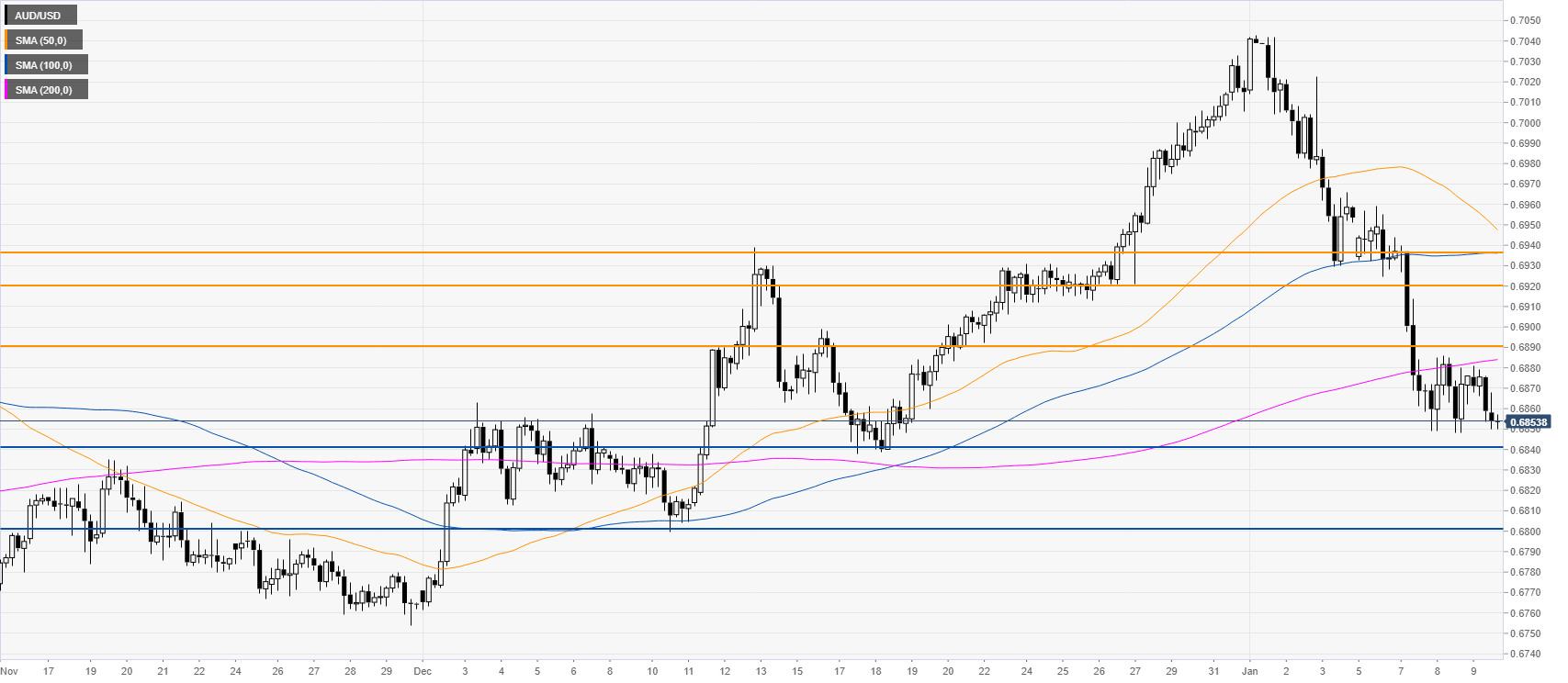

AUD/USD four-hour chart

The Australian dollar is under bearish pressure below both the 0.6890 resistance and the 200 SMA on the four-hour chart. The spot is currently consolidating the recent losses as bears want a break below 0.6840 support to reach the 0.6800 handle. However, in the event bulls retake the 0.6890 level, the correction can potentially reach the 0.6920 and 0.6935 levels, according to the Technical Confluences Indicator.

Additional key levels