Back

9 Jan 2020

Oil Price Analysis: WTI vulnerable below $60 a barrel

- WTI had a strong selloff yesterday (Wednesday).

- The level to beat for bears is the 59 support.

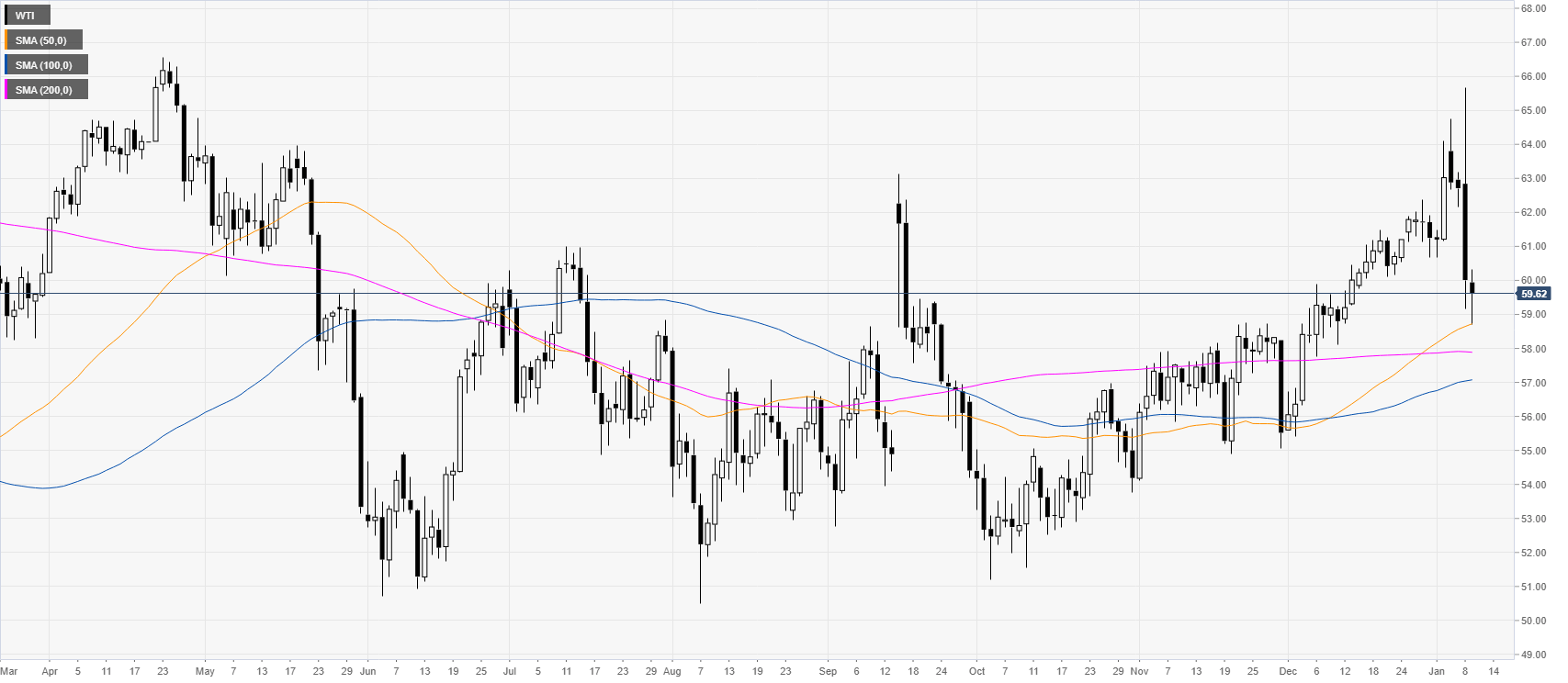

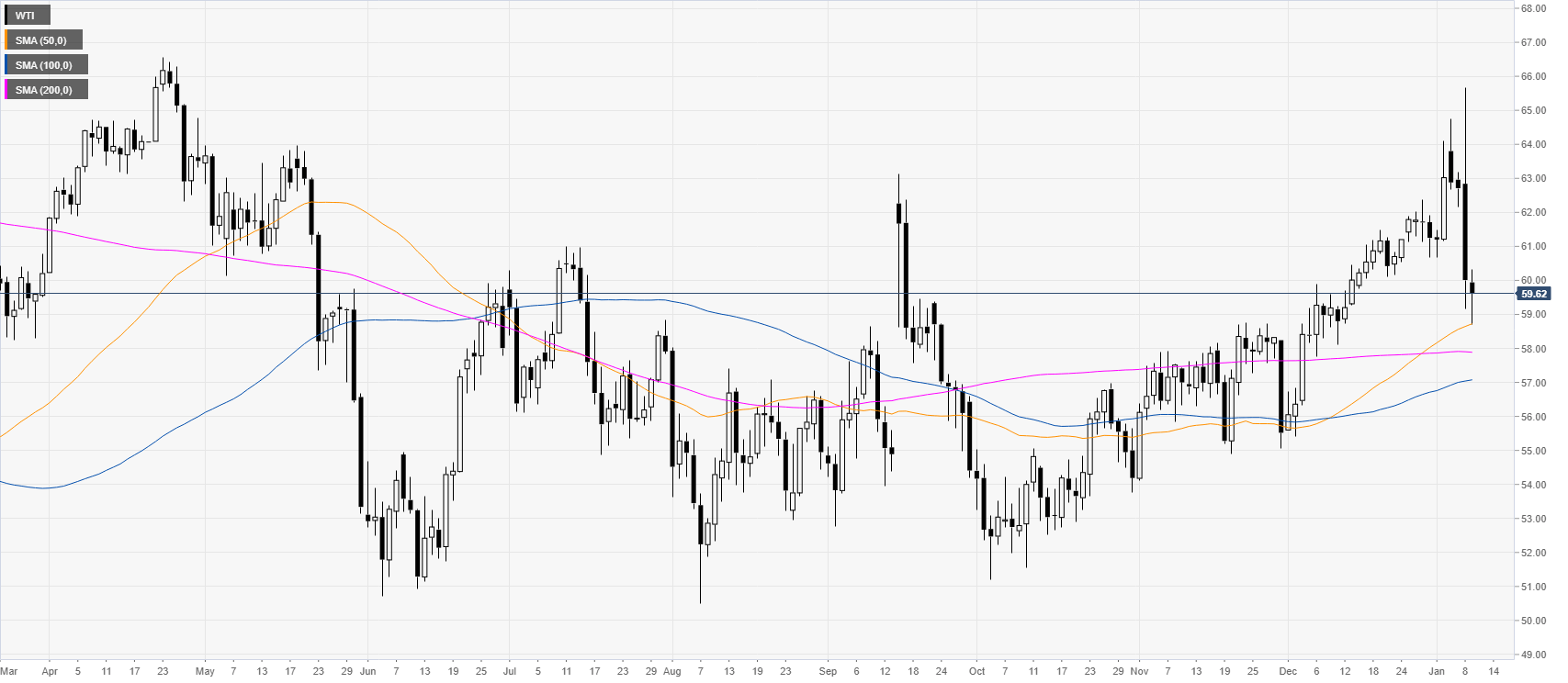

Crude oil daily chart

The crude oil West Texas Intermediate (WTI) rejected the 65 handle while maintaining above the main SMAs. Thursday was a consolidation day and is about to end within Wednesday’s range.

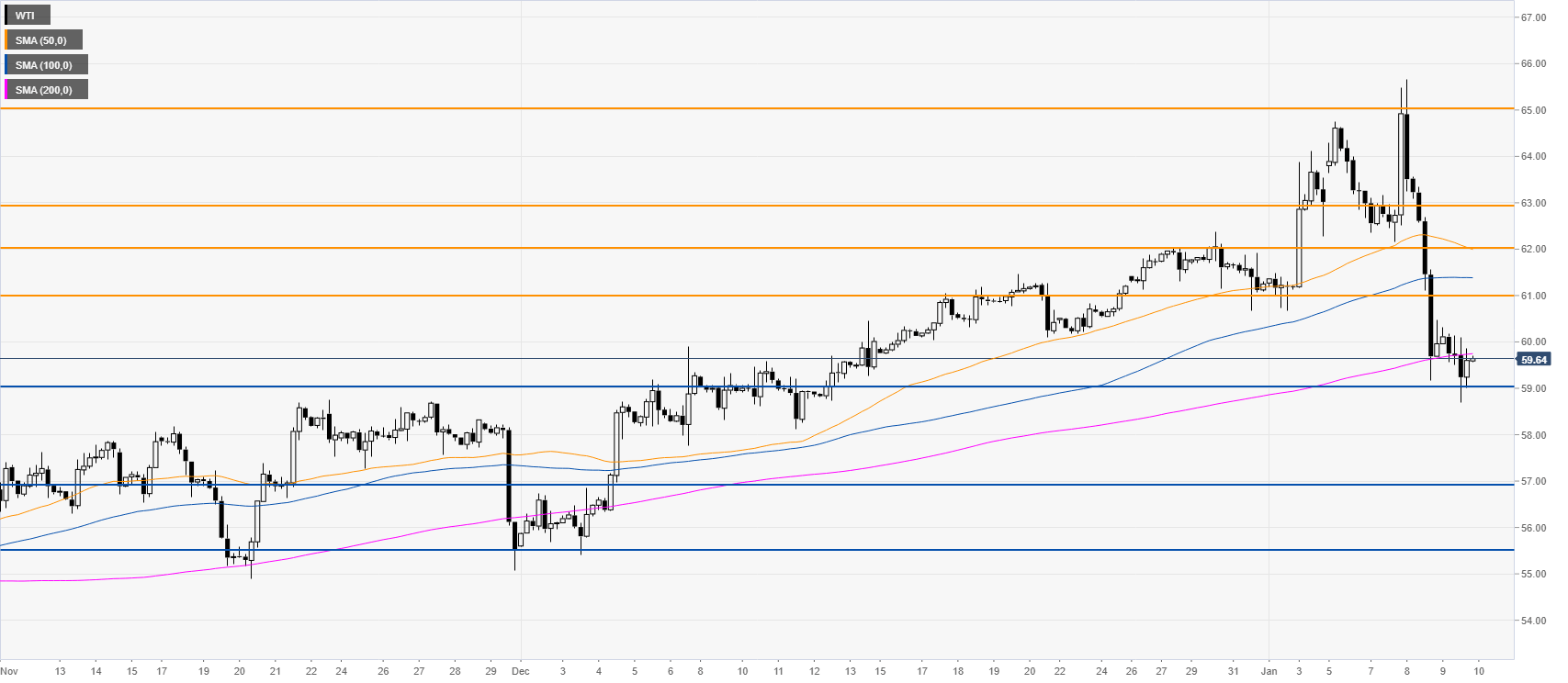

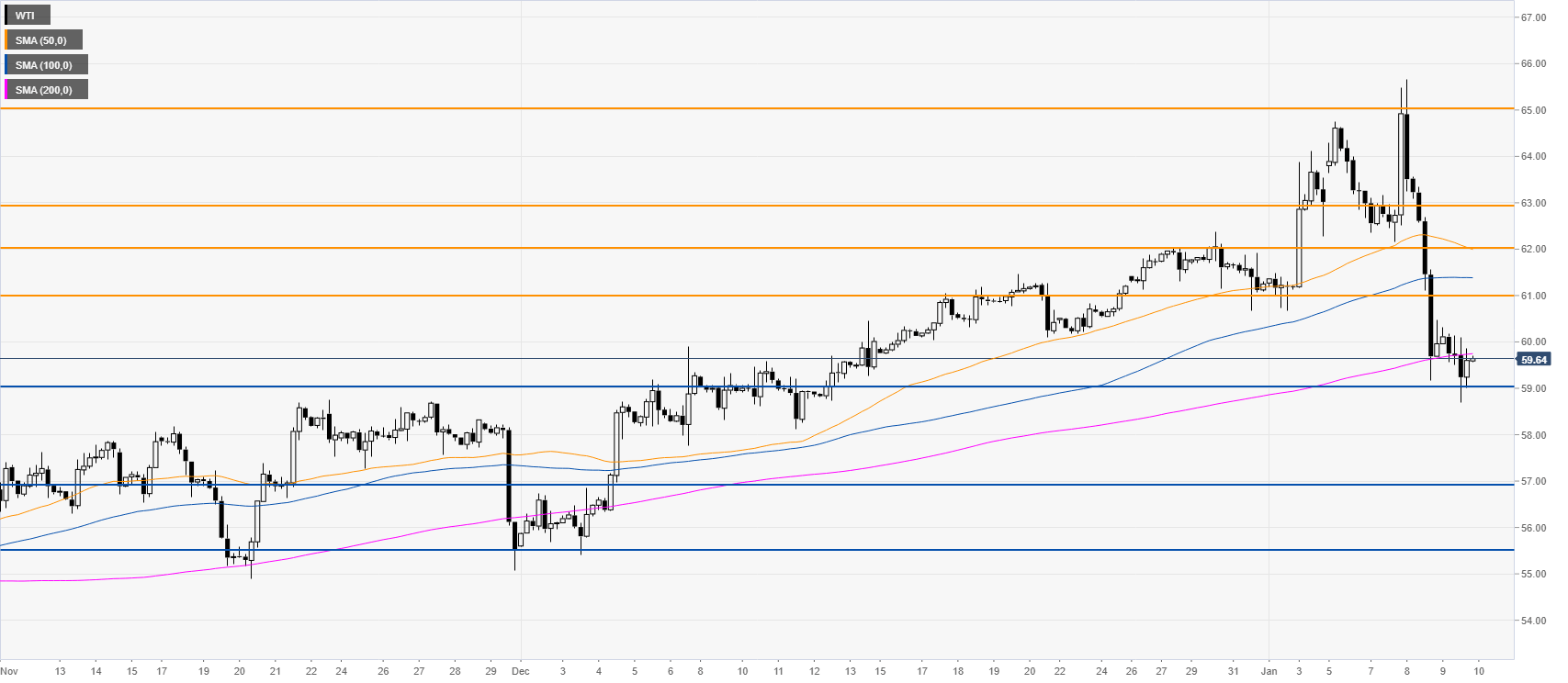

Crude oil four-hour chart

Black gold is consolidating the sharp selloff to $59 a barrel and the 200 SMA on the four-hour chart. As the bears are keeping the pressure on, the market is more likely to continue to drift lower towards 57 and 55.50 price levels. However, a consolidation in the 61/59 range is not to be ruled out. Resistances are seen near 61, 62 and 63 handles.

Additional key levels