Back

20 Feb 2020

EUR/USD New York Price Forecast: Euro consolidates losses near 34-month lows, trades near 1.0800 level

- EUR/USD remains under heavy selling pressure near 34-month lows.

- The level to beat for bears is the 1.0793 support.

- Key resistance is seen near 1.0883 level.

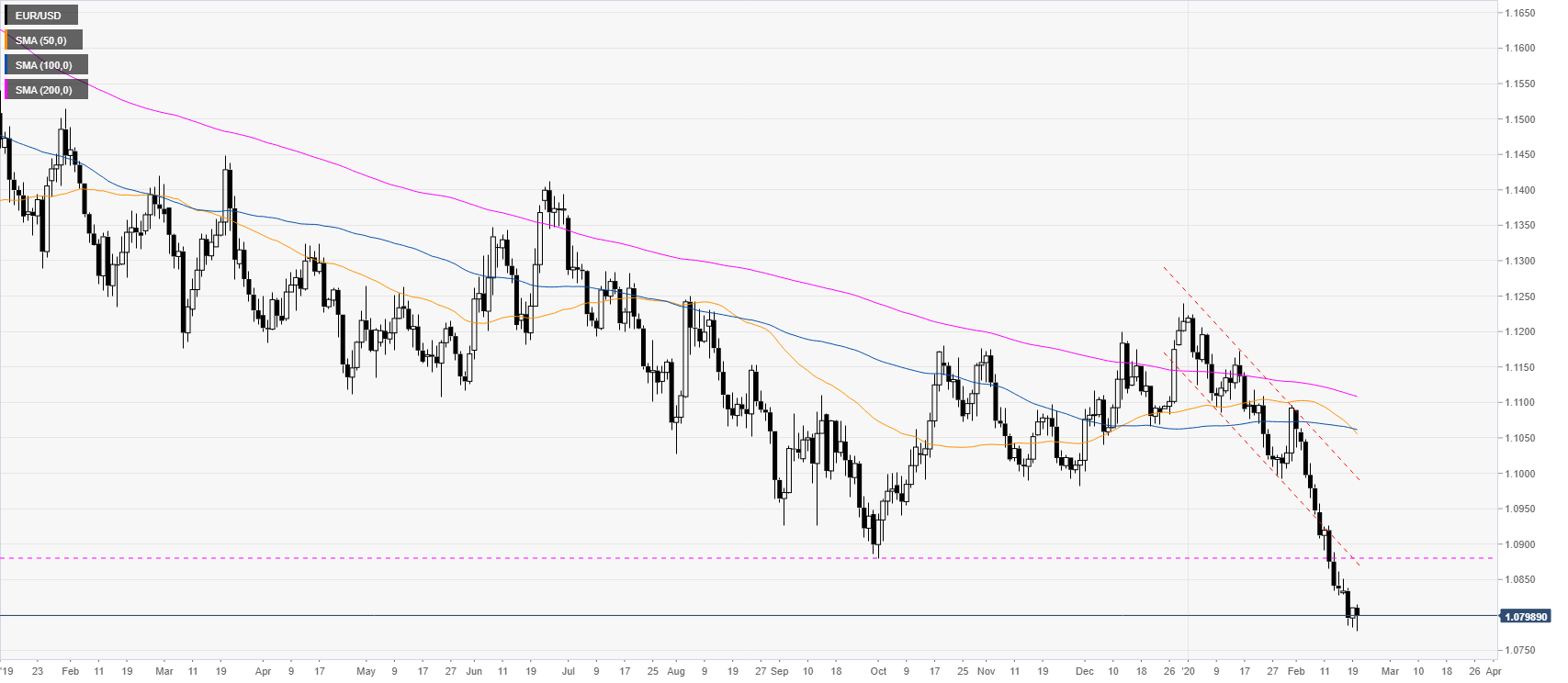

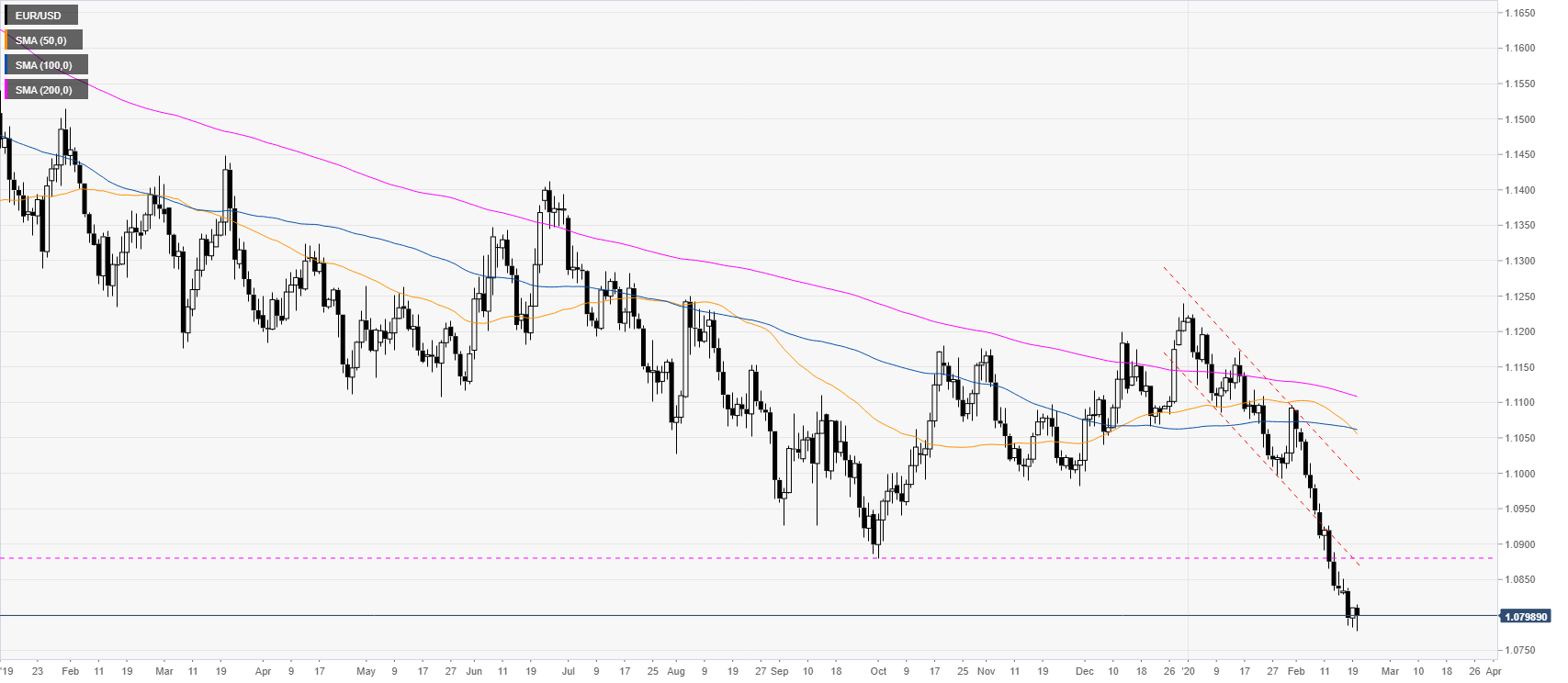

EUR/USD daily chart

EUR/USD is trading in a downtrend below its main daily simple moving averages (SMAs) as the spot is under bearish pressure near 34-month lows. On Wednesday EUR/USD ended the day on the high tick however the buyers have more work to do in order to create a convincing recovery.

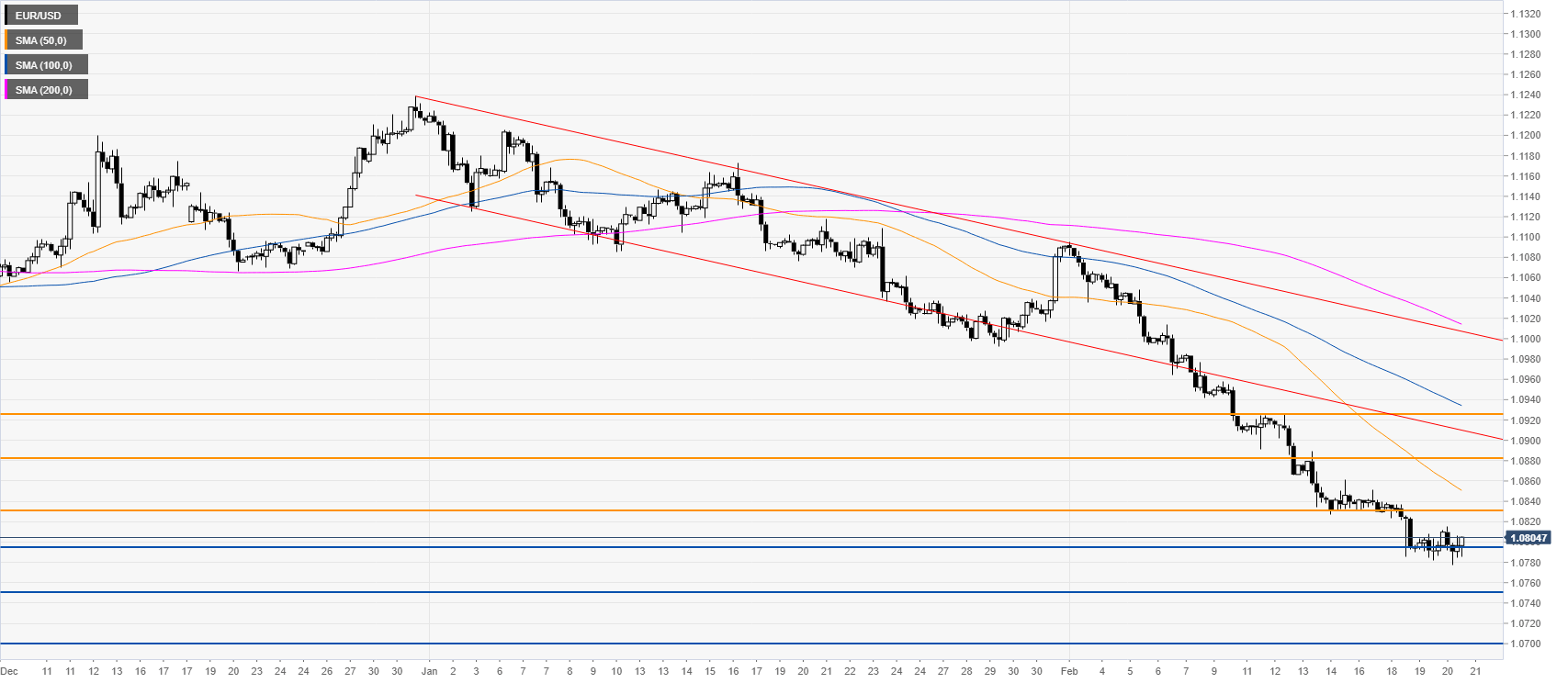

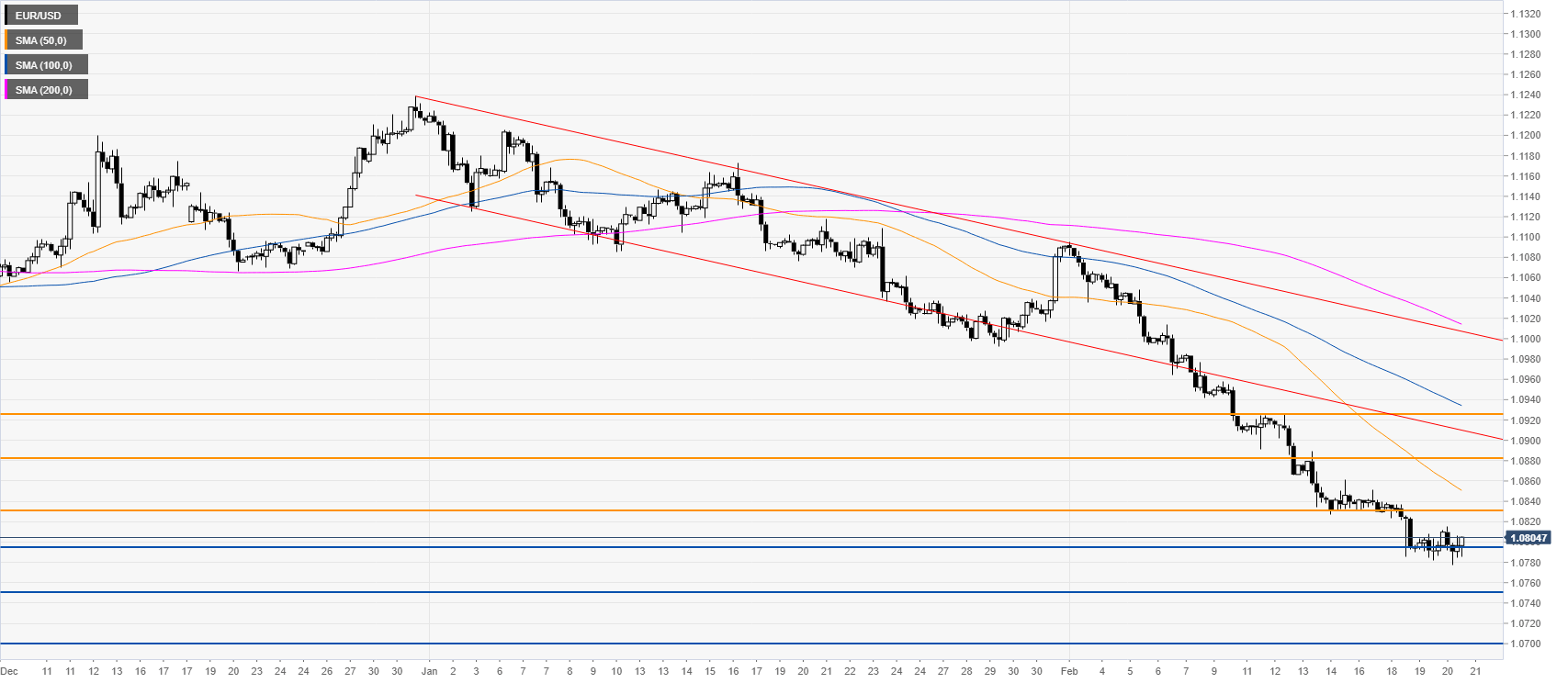

EUR/USD four-hour chart

Euro/Dollar broke below a bear channel while trading far away from its main SMAs on the four-hour chart. On the fourth day of the week, the spot remains under pressure near multi-year low as EUR/USD remains vulnerable below the 1.0793 level. Sellers can target the 1.0748 and 1.0725 levels on the way down. On the flip side, bulls want to recapture the 1.0838 level to trade towards a more solid resistance near 1.0883 level, according to the Technical Confluences Indicator.

Resistance: 1.0838, 1.0883, 1.0917

Support: 1.0793, 1.0748, 1.0725

Additional key levels