Back

16 Mar 2020

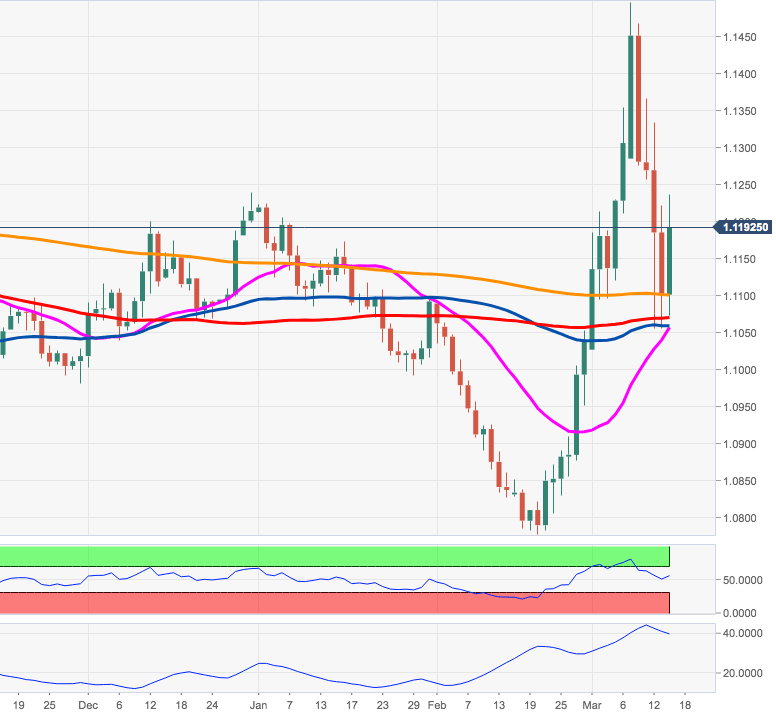

EUR/USD Price Analysis: Target is now at 1.1240

- EUR/USD regains composure and marches above 1.1200.

- Immediately on the upside emerges the late December top at 1.1239.

EUR/USD has regained upside traction at the beginning of the week, managing to advance as far as the 1.1230 region, printing at the same time 2-day highs.

While above the 200-day SMA, today at 1.1099, the pair’s stance should remain as positive.

Against this backdrop, the interim resistance aligns at 1.1239 (late December top) ahead of 2020 highs in levels just shy of 1.15 the figure.

EUR/USD daily chart