WTI collapses to the $29.00 region, 2020 lows in sight

- Prices of the WTI fall nearly 12% on Monday to the $29.00 region.

- Saudi Arabia-Russia price war keeps weighing on sentiment.

- Developments from the COVID-19 maintain the demand depressed.

Prices of the West Texas Intermediate have started the week on a much weaker tone and are holding on around the $29.00 mark per barrel at the time of writing - down nearly 12% for the day.

WTI focused on coronavirus, price war

The march south in crude oil prices remains unabated on Monday, fuelled by increasing panic stemming from the coronavirus and its impact on the global economy and in particular on the demand for the crude oil in China.

On the supply side, there is no news regarding the current Russia-Saudi Arabia price war. In fact, making things worse, the Kingdom announced earlier in the day that it plans to increase the oil output to full capacity.

In the meantime, crude oil dynamics have a life of its own and it have utterly ignored the extra 100 bps interest rate cut by the Federal reserve on Sunday, aimed to mitigate the impact of the COVID-19 on the US economy.

Later in the week, traders’ focus is expected to remain on the usual weekly report by the API (Tuesday) and the EIA (Wednesday) ahead of the US oil rig count by driller Baker Hughes on Friday.

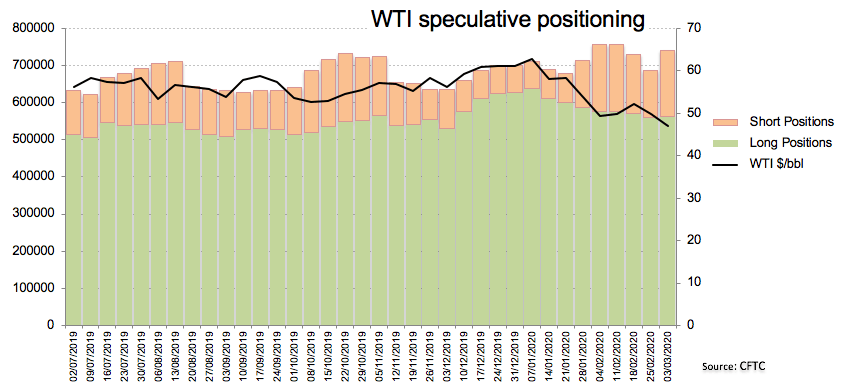

On another front, the speculative community trimmed their net longs to the lowest level since late October 2019 during the week ended on March 10, as per the latest CFTC report.

What to look for around WTI

Crude oil prices remain under pressure amidst challenges from the demand side via the impact of the COVID-19 on the global economy, and particularly on the Chinese economy, which is the second largest oil importer in the world. Negative drivers on the supply side come from the ongoing Russia-Saudi Arabia price war, which is expected to remain unabated in the near-term and aggravated by the tangible possibility that Saudi Arabia ramps up its oil production by nearly 12M bpd.

WTI significant levels

At the moment the barrel of WTI is losing 11.84% at $28.97 and a breach of $27.29 (2020 low Mar.9) would expose $26.61 (monthly low Sep.2003) and finally $25.80 (monthly low Apr.2003). On the upside, the next hurdle comes in at $36.28 (high Mar.11) seconded by $40.00 (round level) and then $44.04 (21-day SMA).