Back

16 Mar 2020

EUR/JPY Asia Price Forecast: Euro stuck in ranges vs. yen, trades near 118.40 level

- EUR/JPY remains sideways in the 117-119 range.

- Support is seen near the 118.17, 117.85 and 117.31 levels.

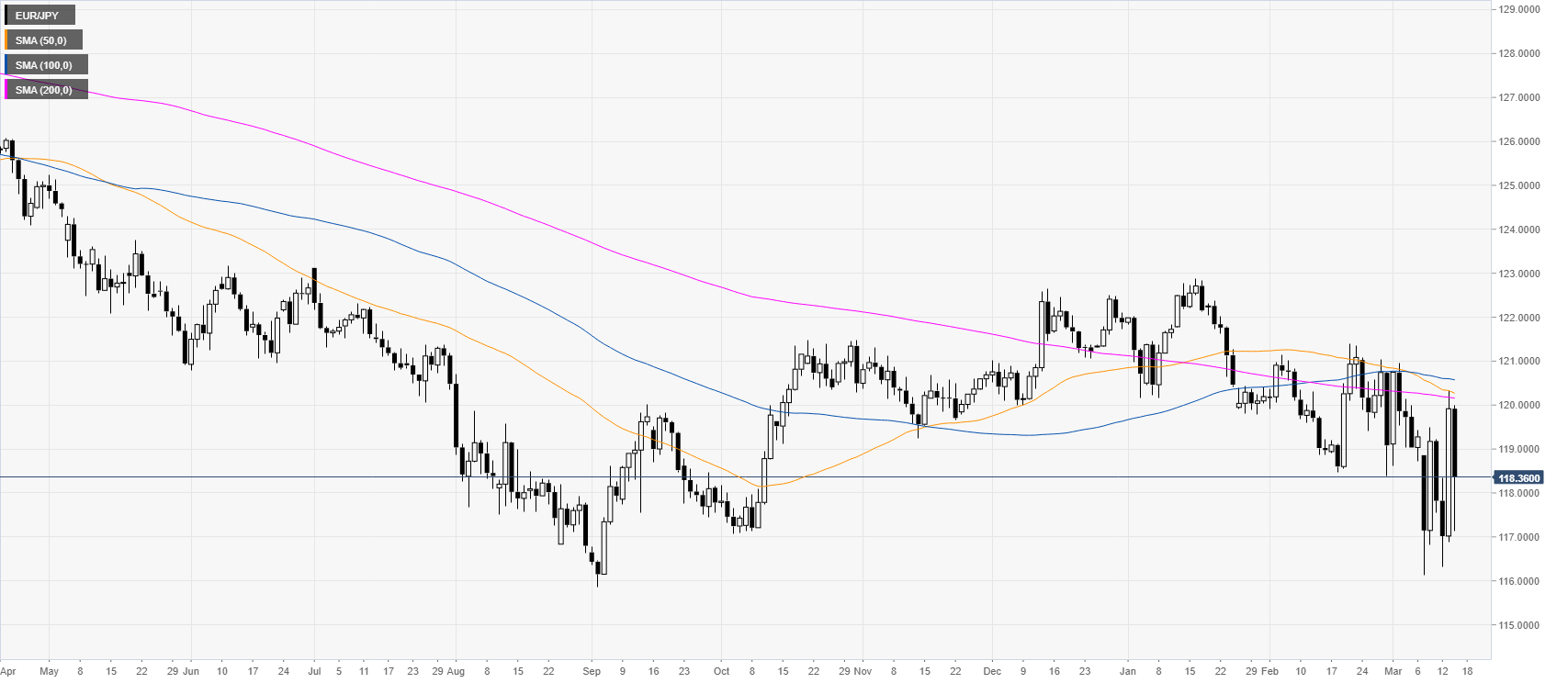

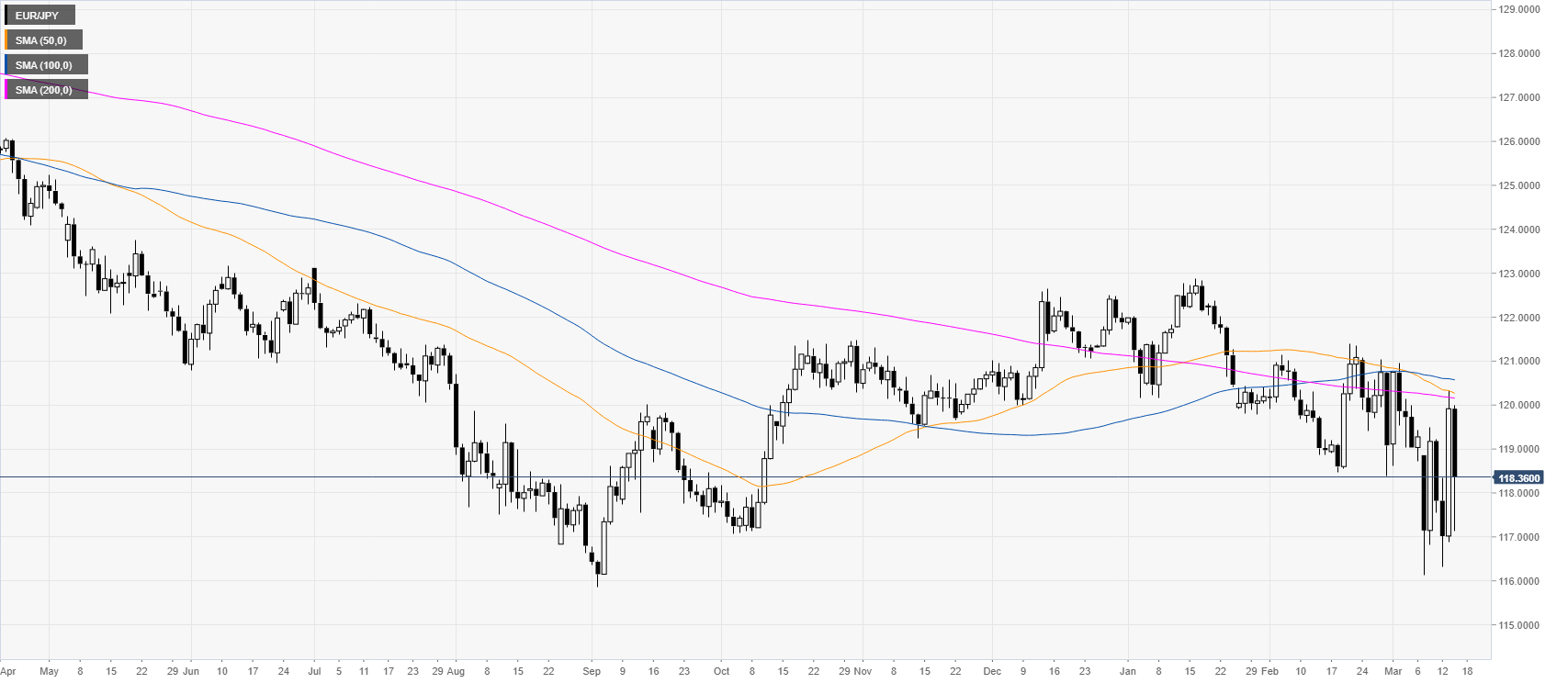

EUR/JPY daily chart

EUR/JPY is trading below the main daily SMAs suggesting a bearish bias in the medium term. The spot is about to end the New York session below the 119.00 figure.

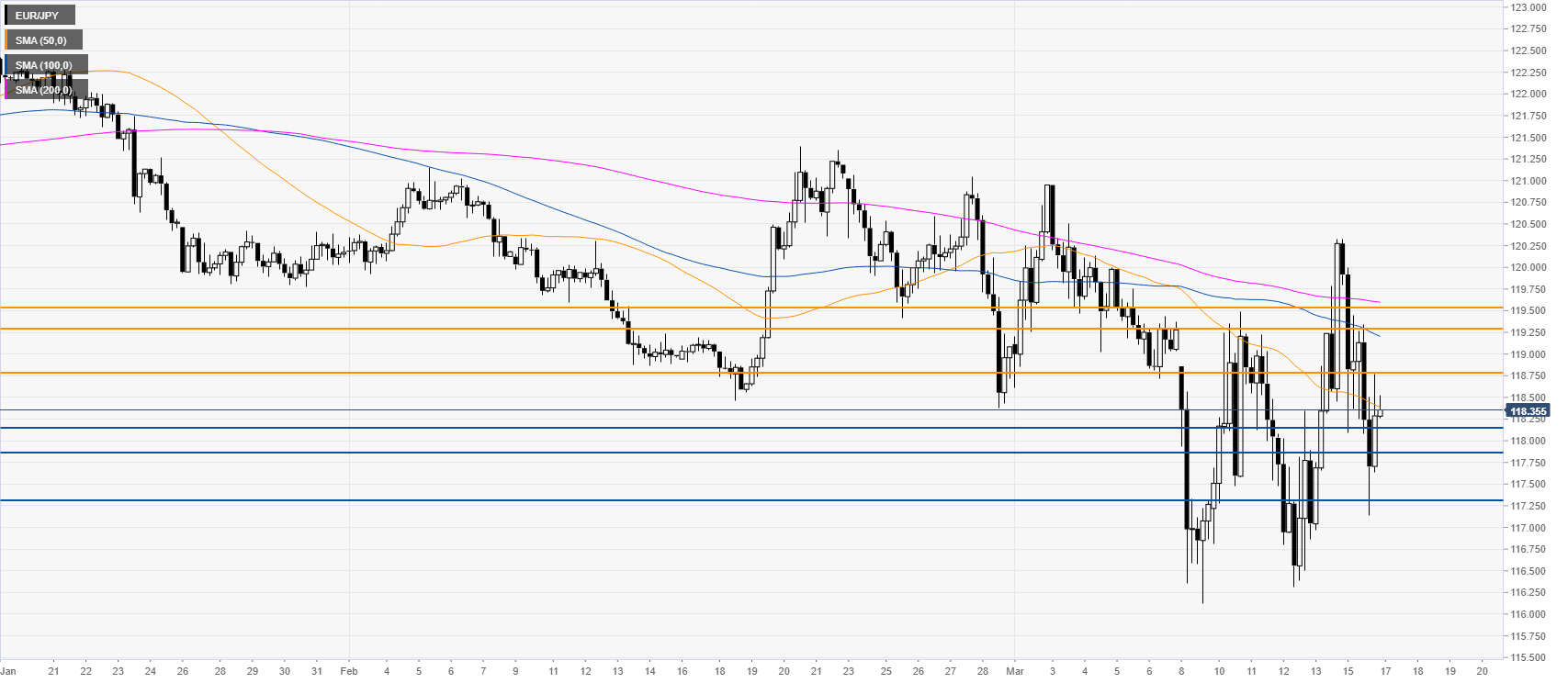

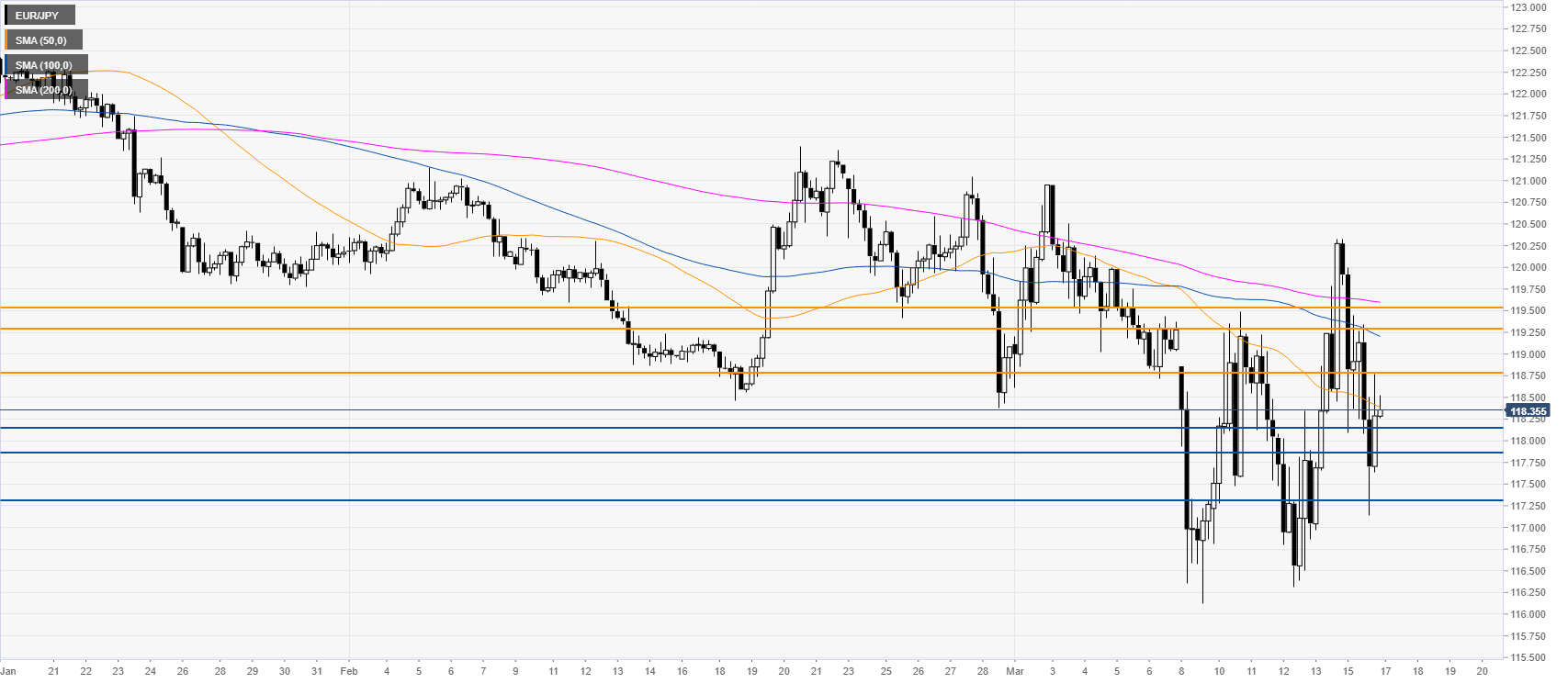

EUR/JPY four-hour chart

EUR/JPY remains sidelined in the 117-119 range as market participants can’t find a direction for the currency cross. The market keeps an underlying bearish bias with the spot trading below the main SMAs on the four-hour chart.

Resistance: 118.79, 119.30, 119.53

Support: 118.17, 117.85, 117.31

Additional key levels