Back

16 Mar 2020

AUD/USD Asia Price Forecast: Aussie trading in 12-year lows ahead of RBA Minutes

- AUD/USD is under selling pressure as the US dollar remains strong.

- The level to beat for bears is the 0.6100 support.

- Reserve Bank of Australia (RBA) Meeting Minutes to be released at 00:30 GMT this Tuesday.

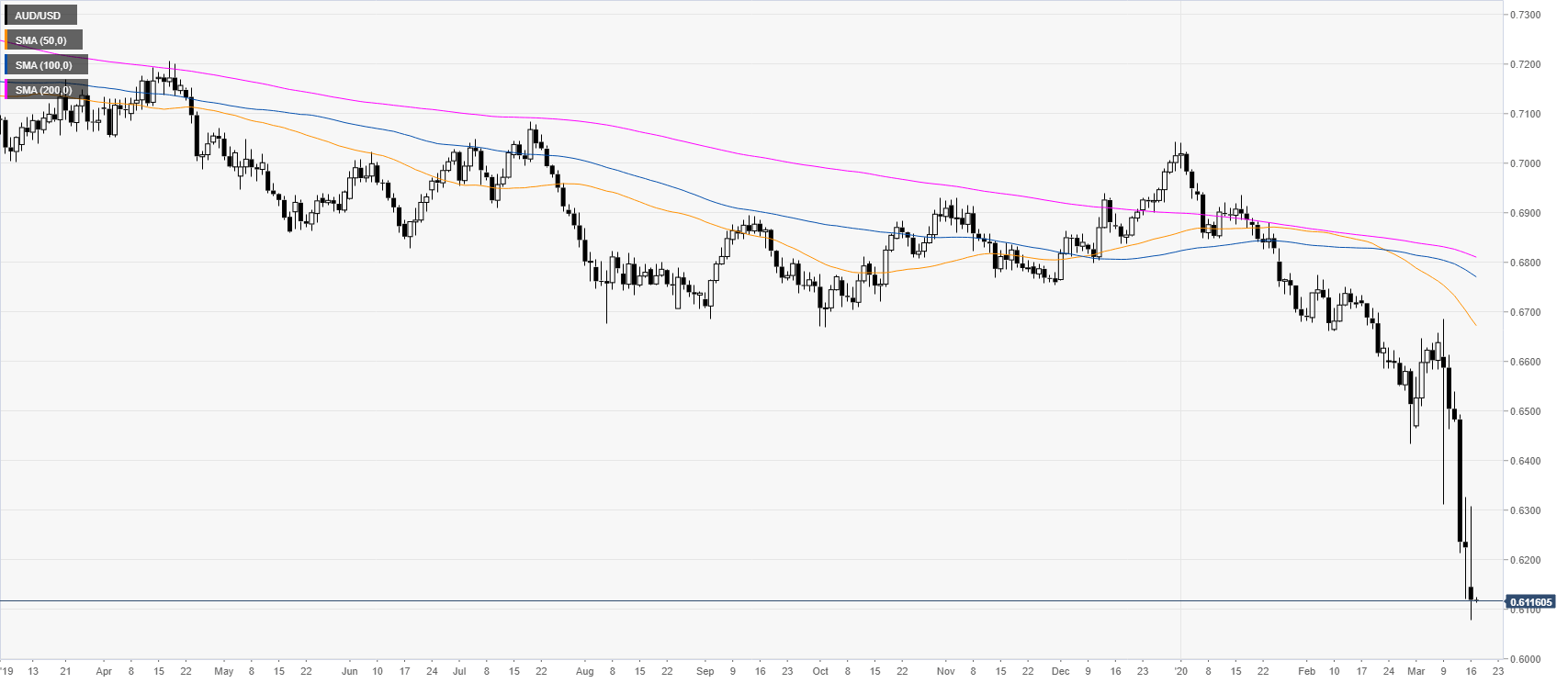

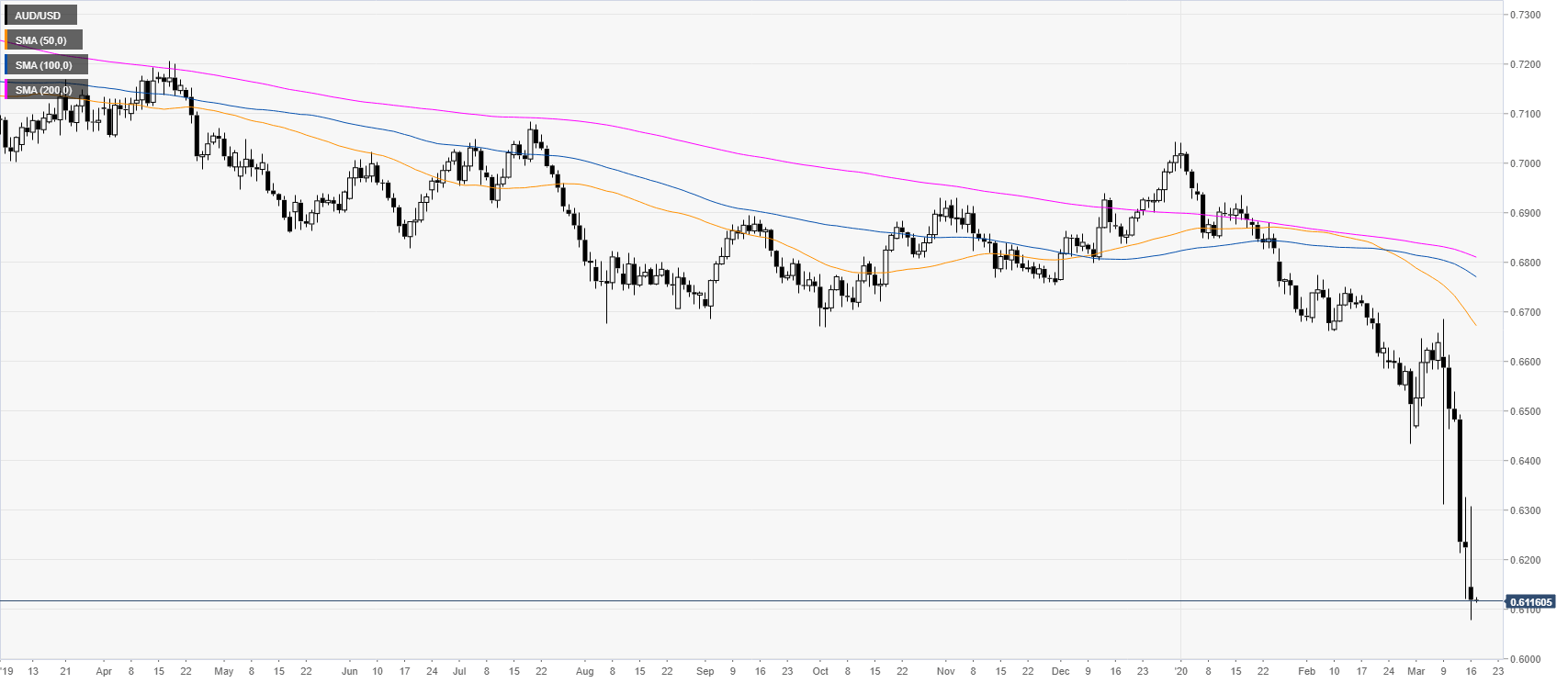

AUD/USD daily chart

The aussie remains extremely vulnerable near 12-year lows while trading well below its main daily simple moving averages (SMAs). The Reserve Bank of Australia (RBA) Meeting Minutes will be released at 00:30 GMT this Tuesday.

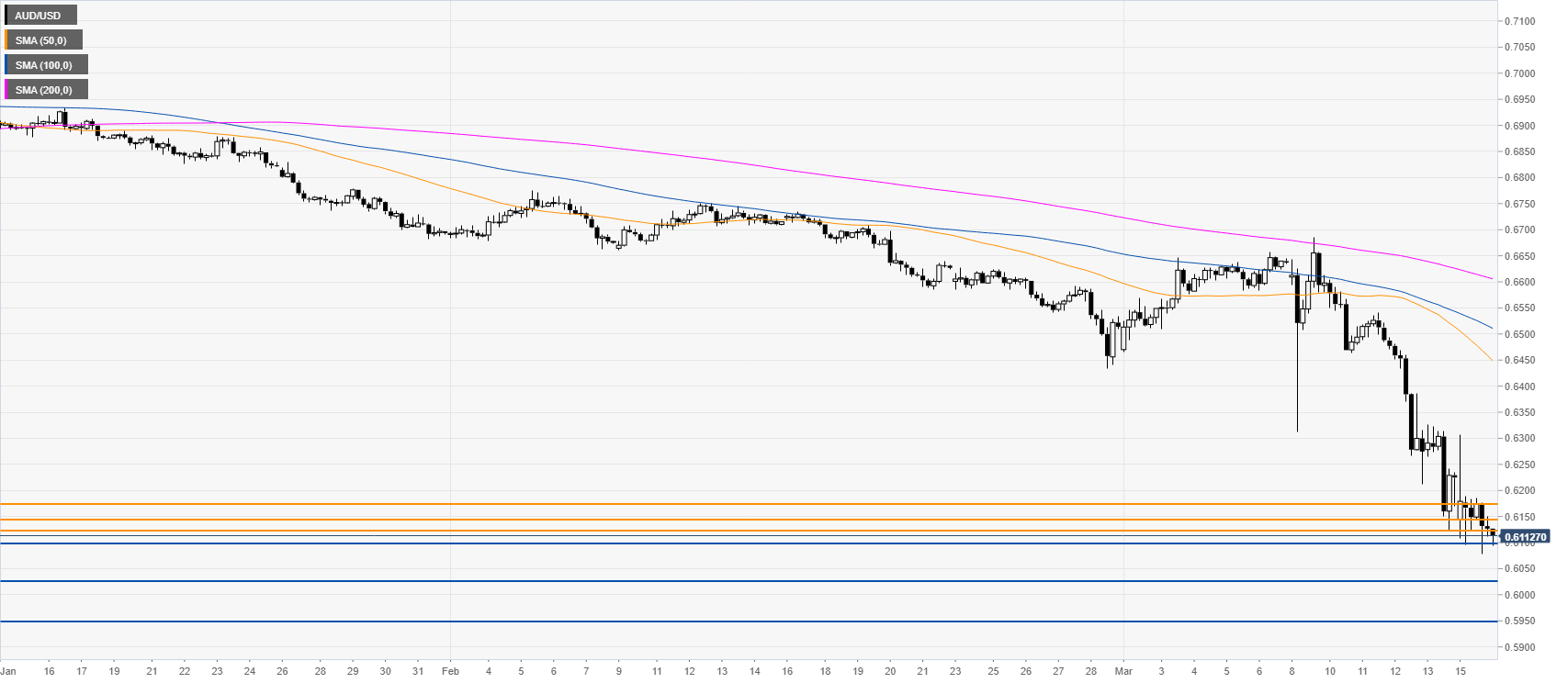

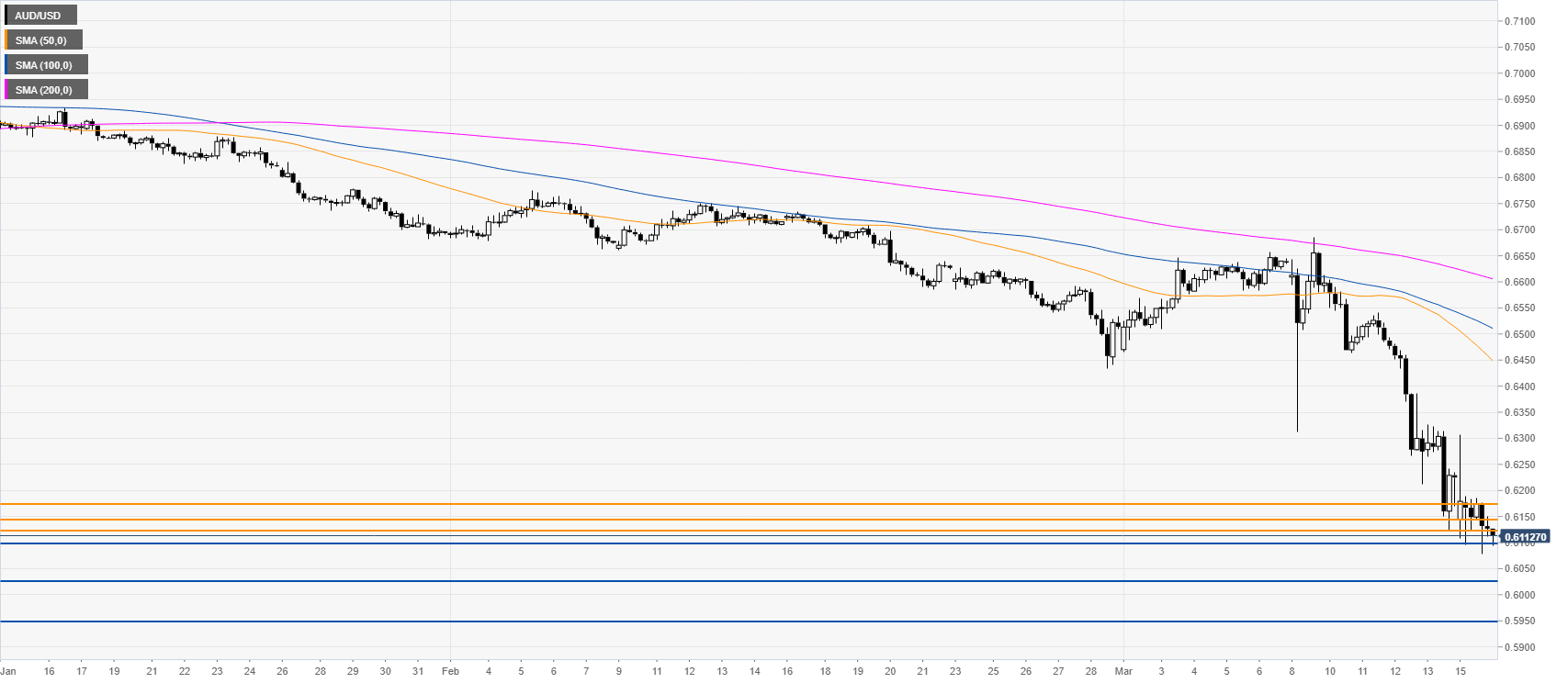

AUD/USD four-hour chart

AUD/USD is under strong selling pressure below the 0.6200 figure and the main SMAs. Bears are in control as DXY remains supported despite the 100bps rate cut by the Fed. Sellers would want to break below the 0.6100 level followed by the 0.6030 and 0.5950 levels on the way down, according to the Technical Confluences Indicator. On the flip side, resistance can be seen near the 0.6135, 0.6153 and the 0.6172 levels.

Resistance: 0.6135, 0.6153, 0.6172

Support: 0.6100, 0.6030, 0.5950

Additional key levels