Back

17 Mar 2020

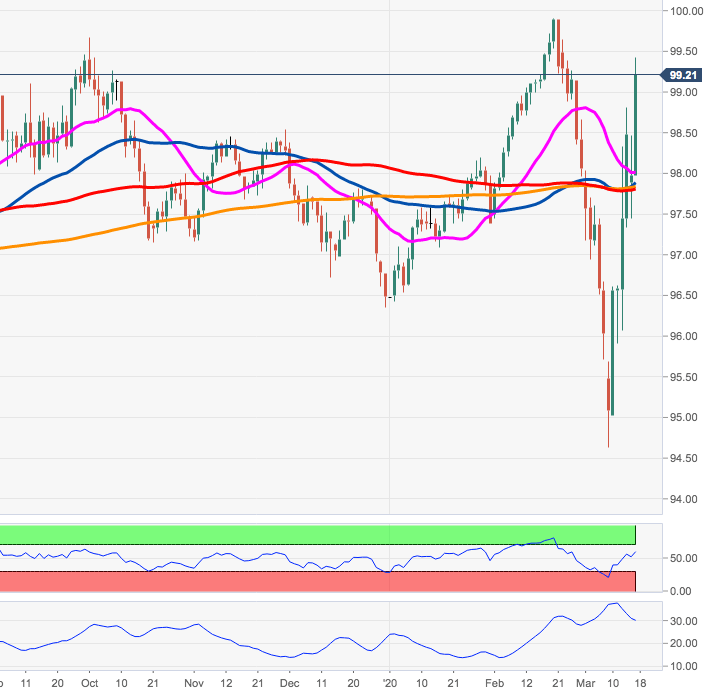

US Dollar Index Price Analysis: Upside momentum could test 100.00

- The upside bias in DXY regains traction and surpasses 99.00.

- The next target on the upside emerges at 2020 high at 99.91.

DXY has resumed the upside after Monday’s pullback and it has now retaken the area above 99.00 the figure.

If bulls keep pushing higher, then the next key level to consider will be the 2020 high at 99.91 (February 20th) ahead of the psychological triple-barrier.

Above the 200-day SMA, today at 97.82, the constructive stance is expected to prevail among traders.

DXY daily chart