Back

20 Jul 2020

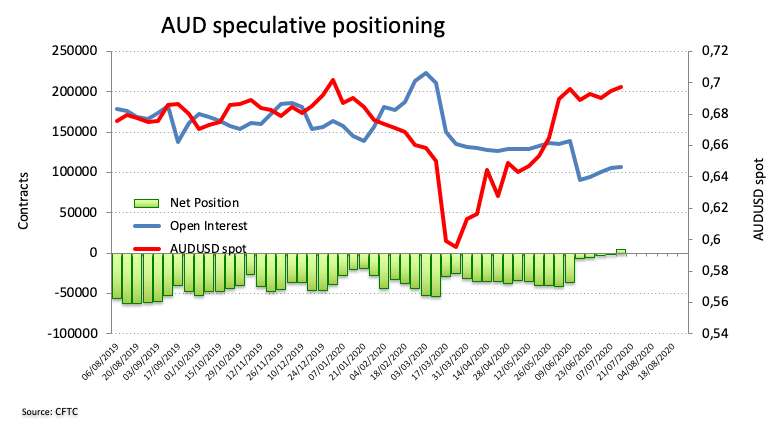

CFTC Positioning Report: AUD back to the positive ground

These are the main highlights of the CFTC Positioning Report for the week ended on July 14th:

- Speculators pushed AUD to the positive territory for the first time since late March 2018. Rising iron ore prices coupled with better-than-forecasted results from both domestic and Chinese fundamentals have been sustaining the change of heart in the speculative community towards the aussie dollar. In addition, the neutral/hawkish stance from the RBA and the government successful handling of the coronavirus pandemic in Australia also added to the upbeat sentiment around the currency.

- Correction in USD continued during last week, with net shorts climbing to the highest level in the last three weeks. The positive context surrounding the risk-associated complex kept the demand for the safe havens subdued along with rising hopes of a coronavirus vaccine and the gradual economic recovery in the US and the Old Continent.

- Net shorts in the British pound receded to levels last seen in early May on the back of some hopes regarding the re-opening of the economy and the generalized upbeat mood in the broad risk complex. However, Brexit concerns, EU-UK trade negotiation and the unabated pandemic should keep the quid under pressure in the next months.