EUR/JPY bulls on firm ground leaning on market's positive risk profile

- EUR/JPY bulls remain in control as the markets continue to grind higher in a positive risk profile.

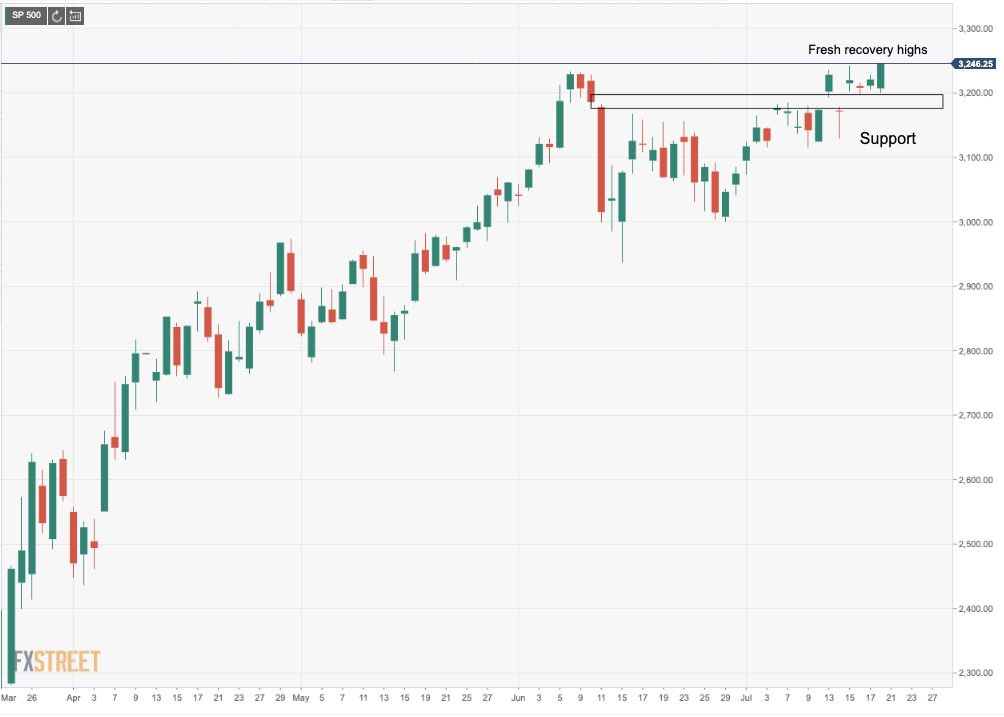

- Intermarket analysis favours the upside, so long as S&P 500 holds above support structure.

EUR/JPY has reached a 78.6% Fibonacci retracement of today's bearish impulse as the yen weakens off.

At the time of writing, the cross is trading at 122.72. within a range of 122.15/97.

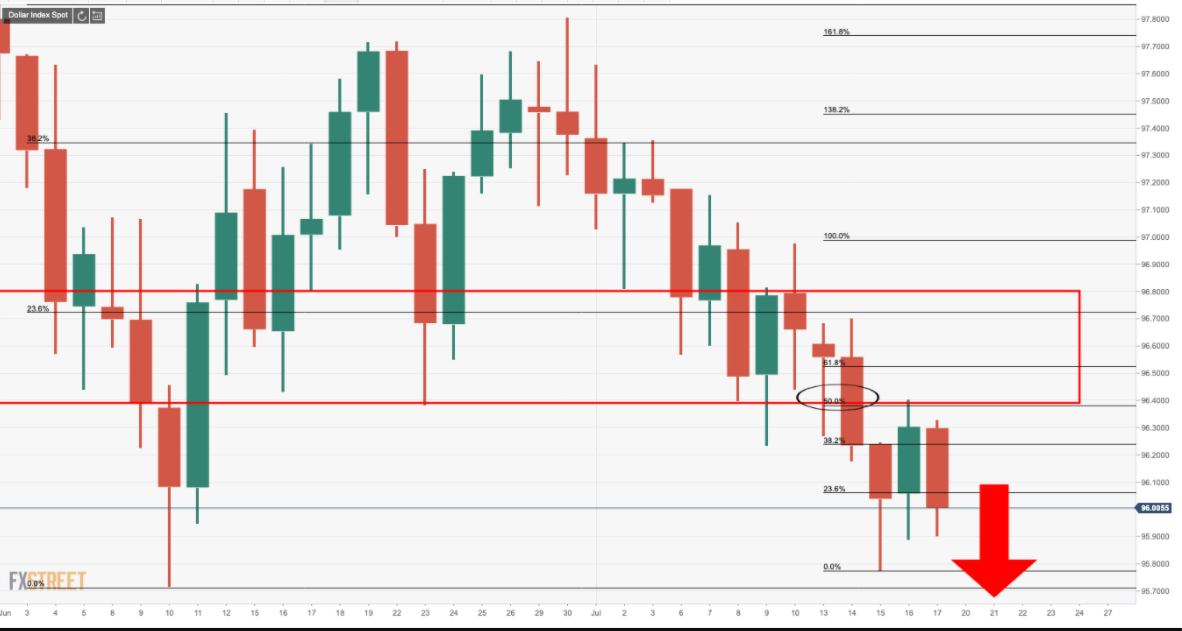

The JXY is trading at 93.20, sliding from a high of 93.40 within the day's range, losing 0.22%. By comparison, the US dollar is a touch firmer in the DXY, losing 0.16%.

The focus to start this week has been on the EU summit: EU reportedly proposes €750 billion in coronavirus stimulus fund – Bloomberg

There are signs that some progress will be made regarding the European Commission’s proposed Recovery Fund which is helping to support the single currency across the board.

- The Chart of the Week: EUR/USD to complete a reverse H&S prior to next leg higher?

Focus on the DXY and S&P 500

Additionally, the bulls are leaning on the fact that the USD net positions have now been in negative territory for five consecutive weeks.

Despite the ongoing uncertainty in the market we have seen markets extend their recoveries in risk appetite in recent months.

The S&P 500 index has made a fresh recovery high and is showing little sign of retreating at this juncture while structurally holding above critical support.

More on this here: S&P 500 Index Weekly Forecast: Nothing but blue skies from now on?

So long as the US dollar remains on the backfoot, the cross, EUR/JPY, stands a good chance of extending its gains.

"Optimism about the re-opening of economies amid huge amounts of stimulus had seen the safe-haven JPY weaken," analysts at Rabobank note.

That said, concerns about a second wave of COVID-19 in addition to China-related tensions could bring some support for the JPY.

EUR/JPY levels