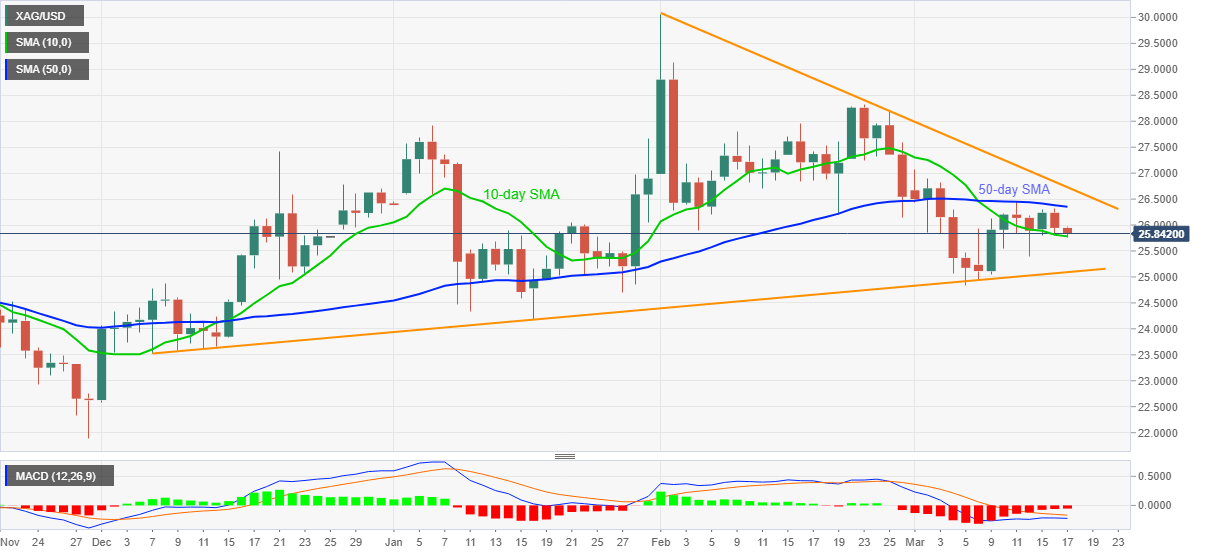

Analisis Harga Perak: SMA 10-hari Menahan Penjual XAG/USD Yang Mengincar Garis Support Utama

- Perak tetap tertekan di sekitar support SMA utama jangka pendek.

- MACD bearish dan perdagangan berkelanjutan di bawah SMA 50-hari mendukung penjual.

- Garis tren turun 1,5 bulan menambah hambatan ke sisi atas.

Perak menyegarkan terendah intraday ke $25,76, saat ini turun 0,43% di dekat $25,85, selama sesi Asia hari Rabu ini. Dengan demikian, logam putih tersebut melanjutkan kinerja suram hari sebelumnya sementara tetap berada di bawah SMA 50-hari selama dua minggu berturut-turut setelah turun di bawah indikator tersebut pada 3 Maret.

Meski begitu, penjual perak berjuang melawan support perantara, SMA 10-hari dekat $25,75, ke garis tren naik utama dari 7 Desember, sekarang di $25,09.

Jika komoditas menembus garis support utama, $25,00 dan terendah bulanan $24,83 dapat bertindak sebagai penyangga selama tren turun selanjutnya.

Sementara itu, pullback korektif mungkin mengamati level SMA 50-hari di $26,35 sebagai rintangan terdekat sebelum mendorong pembeli perak menuju garis resistance penting dari 1 Februari di dekat $26,75.

Secara keseluruhan, perdagangan perak yang berkelanjutan di bawah SMA penting dan MACD bearish mendukung penjual yang mengincar pelemahan lebih lanjut.

Grafik harian perak

Tren: Bearish