Back

20 Apr 2021

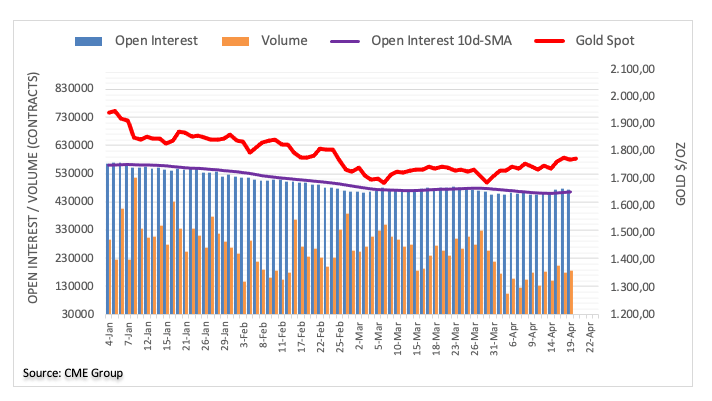

Gold Futures: Correction likely near-term

CME Group’s flash data for Gold futures markets noted open interest shrunk for the first time on Monday after four consecutive daily builds, this time by around 1.6K contracts. Volume, instead, reversed the previous day’s drop and went up by nearly 7.5K contracts.

Gold still targets $1,800

Gold prices advanced to the $1,790 area on Monday, although it ended the session with losses. The move was accompanied by shrinking open interest, indicative that a knee-jerk could be in the offing in the very near-term. On the upside, in the meantime, the yellow metal continues to target the key $1,800 mark per ounce troy.