USD/CAD Price Analysis: Rounding top on 4H keep sellers hopeful around 1.2500

- USD/CAD stays depressed near intraday low inside a bearish chart formation.

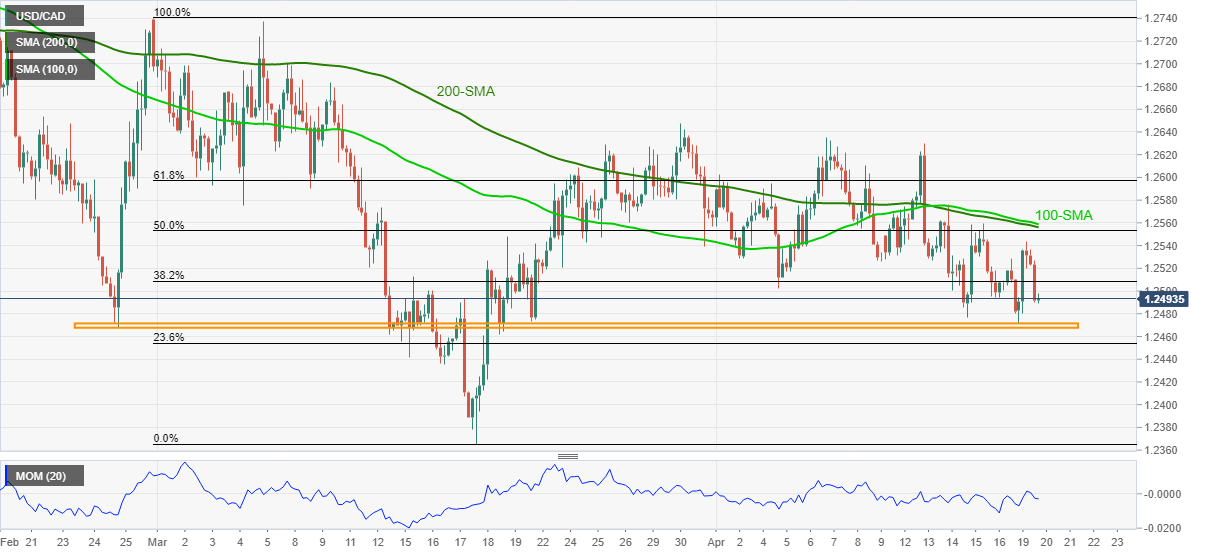

- A confluence of 200 and 100 SMAs will test recovery moves, sellers can eye March low.

- Downbeat Momentum, failures to recover back sellers but a clear break of 1.2470-65 should provide extra strength to the sellers.

USD/CAD remains pressured around 1.2495, down 0.31% intraday, while heading into Tuesday’s European session. In doing so, the loonie pair teases confirmation of the rounding top bearish chart pattern on the four-hour (4H) play.

Given the downbeat Momentum indicator and the quote’s inability to cross 100 and 200-SMA confluence during the bounce-off two-month-old support area, USD/CAD is likely to confirm the bearish technical formation.

However, a clear break below 1.2470-65 should offer extra positives for the USD/CAD bears targeting March lows near 1.2365. During the fall, the 1.2400 round figure may offer an intermediate halt.

Alternatively, a clear upside break of the key SMA confluence near 1.2555-60 will target the late March top surrounding 1.2650. Though, 61.8% Fibonacci retracement level of February 28 to March 18 downside, near the 1.2600 trhreshold, will act as an intermediate halt during the rally.

Overall, USD/CAD is on a bearish trajectory but needs confirmation for further weakness.

USD/CAD four-hour chart

Trend: Bearish