Back

20 Apr 2021

Natural Gas Futures: Scope for further gains

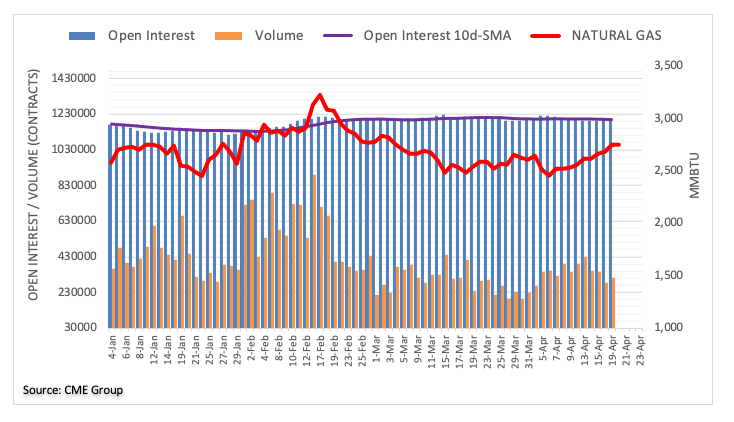

In light of advanced readings for Natural Gas futures markets from CME Group, open interest rose for the second session in a row at the beginning of the week, now by more than 4K contracts. Volume followed suit and went up by around 27.7K contracts, reversing at the same time three daily drops in a row.

Natural Gas now eyes $2.90

Prices of Natural Gas extended the rally on Monday amidst rising open interest and volume, opening the door to the continuation of this trend at least in the very near-term. That said, the next hurdle lines up at the March highs around the $2.90 mark per MMBtu.