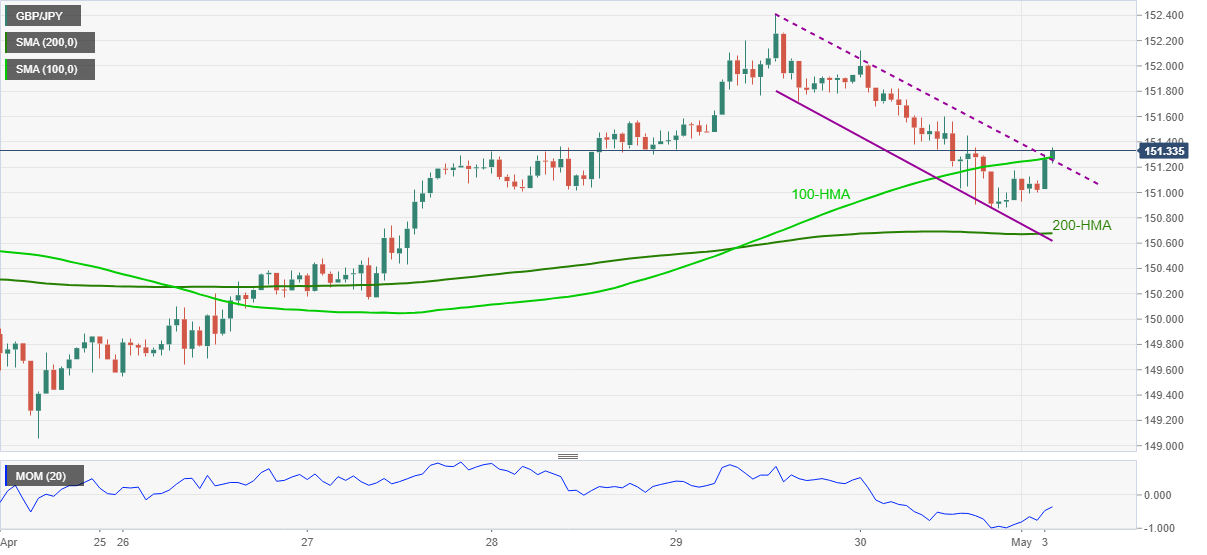

GBP/JPY Price Analysis: Refreshes intraday top on crossing 151.30 short-term key hurdle

- GBP/JPY is on the bids after clearing an immediate hurdle, now support, comprising 100-HMA, two-day-old falling channel.

- Upbeat Momentum adds strength to the bullish move, 200-HMA offers extra filters to the south.

GBP/JPY rises to 151.33, up 0.15% intraday, after piercing the key resistance confluence amid early Monday. In doing so, the quote crossed a convergence of 100-HMA and the upper line of the falling channel since last Thursday.

Given the upward sloping Momentum also favoring GBP/JPY run-up, the quote is well-set to challenge the 152.00 round-figure ahead of targeting the previous week’s top surrounding 152.40.

It should, however, be noted that any further upside past-152.40 will be tested by the yearly peak surrounding 153.40.

On the flip side, pullback moves below 151.30 may bounce off the recent low close to 150.85, if not then a 200-HMA level of 150.67 can challenge the short-term sellers.

It’s worth mentioning that the support line of the stated channel, around 150.60, also holds the gate for GBP/JPY seller’s entry.

GBP/JPY hourly chart

Trend: Bullish