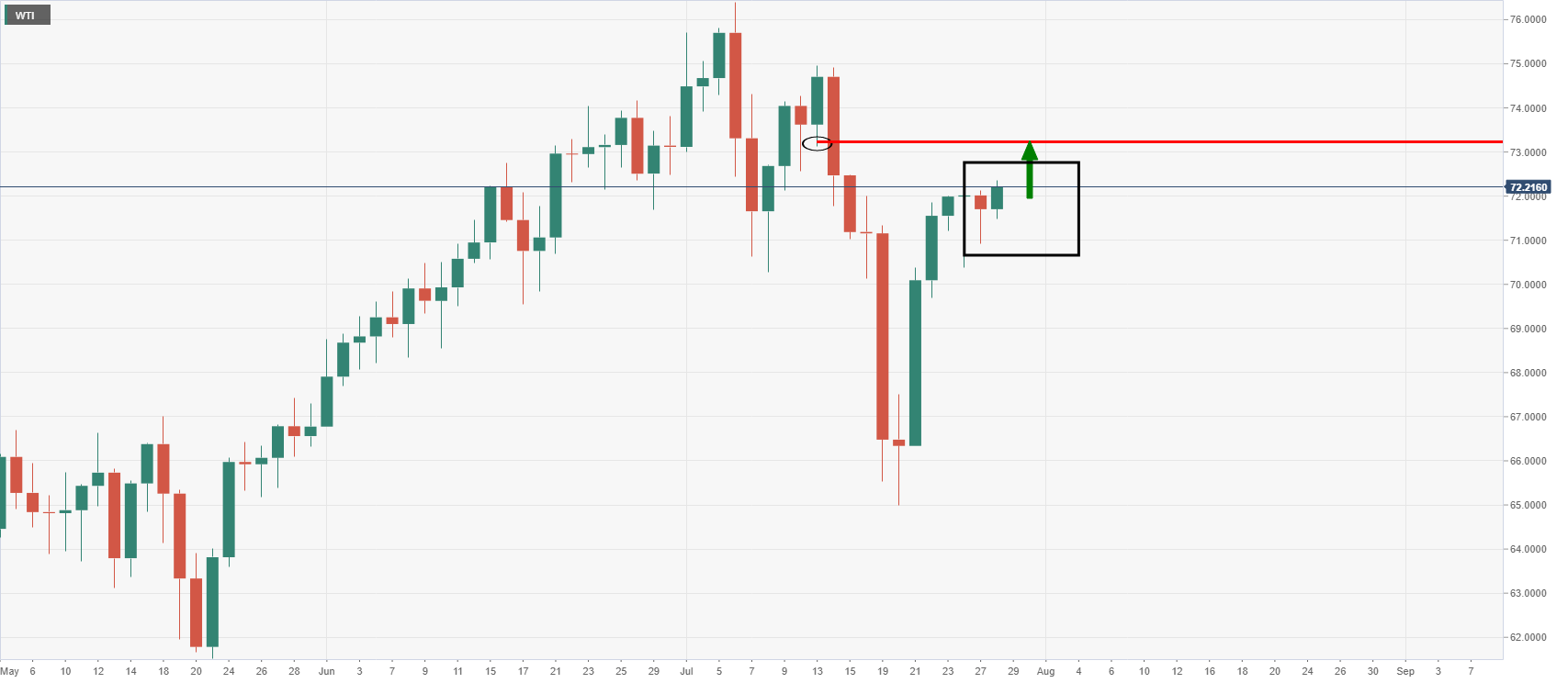

WTI bulls targetting a test deeper into resistance

- WTI bulls are back to the table looking for a test of the 74 areas.

- Demand vs supply tightness and a softer dollar is underpinning the energy complex.

US West Texas Intermediate (WTI) spot is trading at $73.35 and near to the highs of the day at $73.47 made on the back of a fresh wave demand and falling US oil inventories.

Following the optimism at the Federal reserve, bulls in the energy markets have the green light to press higher with a view that demand will outstrip tight supplies despite OPEC+ readies to add 400,000 barrels per day to the market next month.

The Federal Reserve's hawkish statement coupled with Jerome Powell's bullish comments to the press, arguing that the US is “clearly on the path to a very strong labour market,” lays down the foundations for higher consumption and demand for energy.

Moreover, despite the risks of the Delta-variant's spread, analysts believe it is unlikely to lead to large scale mobility restrictions. ''In this context, time spreads should tighten further with large deficits expected in the coming month,'' analysts at TD Securities said.

''While the delta-variant continues to spread in the US, it is unlikely to meaningfully tighten mobility restrictions and derail the recovery in energy demand. Elsewhere, road traffic in Asia continues to recover while air travel is also rising at a fast clip, particularly in Europe, but with the US and China also continuing to post gains,'' the analysts also explained.

Meanwhile, the Energy Information Administration on Wednesday said crude oil inventories fell by 4.1 million barrels last week to the lowest since January 2020, while gasoline stocks fell by 2.3 million barrels.

This was another bullish factor in the move up and traders have figured that demand is continuing to improve as pandemic restrictions are relaxed.

Rising supplies could check prices, however, the EIA reported that U.S. production dropped by 200,000 bpd to 11.2-million bpd last week.

Meanwhile, Iran remains a wild card for the energy market.

''Concerns are emerging surrounding the Iran nuclear deal, as Raisi readies to take office,'' the analysts at TD Securities warned.

''While Iran could add over 1 million bpd of crude and products if talks are successful, hurdles to an imminent negotiated agreement are increasingly observable. This leaves the energy market in a strong position, as capital discipline keeps shale plays on the sidelines.

WTI price analysis

In a note ahead of the Fed yesterday, WTI on the way to test a critical resistance target ahead of Fed,

it was stated that the bulls can target the 78.6% Fibonacci retracement of the prior bearing impulse that has a confluence with the 13 July lows at 73.13:

We have now surpassed that level and the focus will be on the highs in the 76 areas so long as 72 holds as support on a restest: