Back

2 Aug 2021

Crude Oil Futures: Neutral/bullish near term

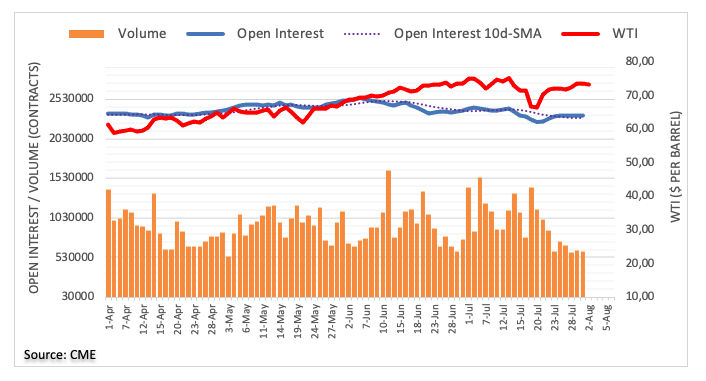

CME Group’s flash data for crude oil futures markets noted traders added around 4.8K contracts to their open interest positions on Friday, reversing two consecutive daily pullbacks. Volume, instead, extended the choppy activity and shrank by nearly 7.8K contracts.

WTI targets $75.00 and above

Friday’s decent gains in prices of the barrel of WTI were against the backdrop of rising open interest, indicative that further upside could be in the pipeline in the very near term. That said, the mid-July peaks around $75.60 remain the next target of note for crude oil.