Back

3 Nov 2021

Gold Futures: Extra downside seen limited

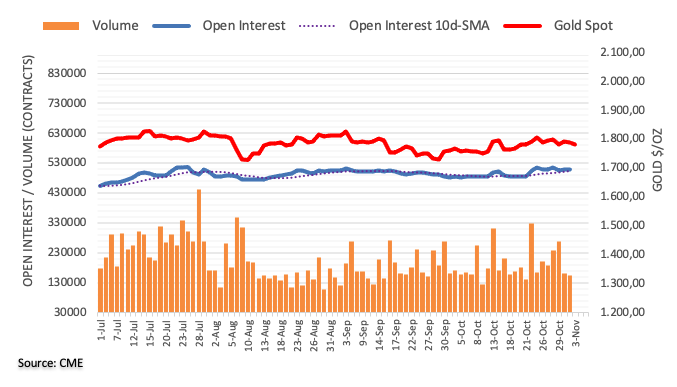

Open interest in gold futures markets shrank by around 1.5K contracts on Tuesday, partially reversing the previous build considering preliminary figures from CME Group. Volume followed suit and dropped for the second session in a row, now by around 6.3K contracts.

Gold remains under pressure below $1,800

Gold extended the pessimism in the first half of the week. Tuesday’s downtick was in tandem with shrinking open interest and volume, leaving the prospect for a deeper pullback somewhat curtailed in the very near term. In the meantime, the $1,800 mark per ounce troy remain as the key resistance for bulls’ aspirations.