Back

8 Feb 2022

Gold Futures: Further gains look likely

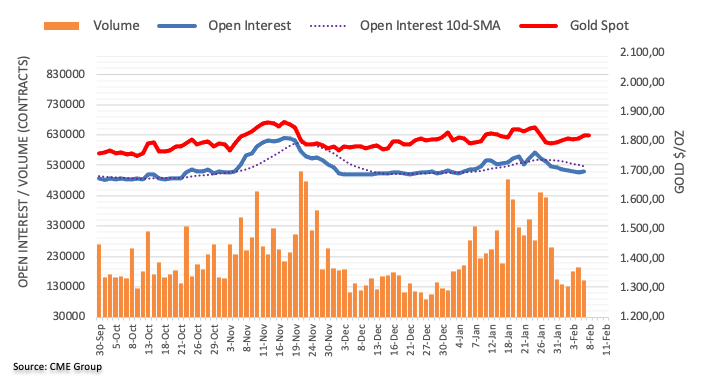

Open interest in gold futures markets increased by around 1.1K contracts at the beginning of the week for the first time since January 26 according to preliminary figures from CME Group. Volume, instead, reversed two daily builds in a row and shrank by more than 41K contracts.

Gold targets the 2022 high at $1,853

Gold started the week on a positive note and retested the $1,820 area. The uptick was amidst rising open interest, allowing for the continuation of the upside with immediate target at the YTD peak at $1,853 (January 25). The moderate decline in volume could prompt some very near-term consolidation ahead of further gains, in the meantime.