Back

8 Feb 2022

Crude Oil Futures: Extra losses on the cards

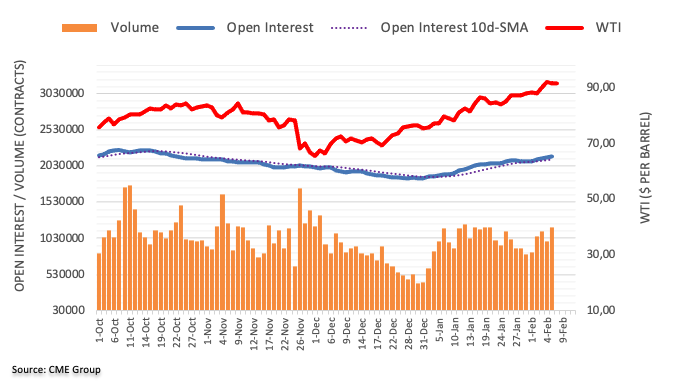

CME Group’s flash data for crude oil futures markets noted traders added nearly 8.5K contracts to their open interest positions on Monday, extending the uptrend for the fourth session in a row. Volume followed suit and resumed the upside following the previous pullback, this time by around 196.8K contracts.

WTI: Next on the downside comes $88.00

The rally in crude oil prices seems to be taking a breather so far this week after hitting fresh cycle tops last Friday. Monday’s downtick was in tandem with rising open interest and volume, which is supportive of extra pullbacks in the very near term at least. Against this, the $88.00 region emerges as the next support of note in case of further decline in WTI.